- Information

- AI Chat

Was this document helpful?

Coy Exploiting Uncertainty The 'Real Options' Revolution in Decision-making Business Week 19990607

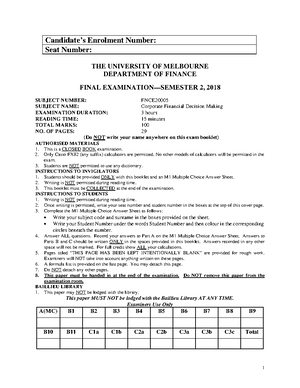

Course: Corporate Financial Decision Making (FNCE20005)

688 Documents

Students shared 688 documents in this course

University: University of Melbourne

Was this document helpful?

Finance

CORPORATE PLANNING

EXPLOITING

UNOERTAINH

The "real-options"

revolution in

decision-making

T

his June, Enron Corp. will

open three gas-fired power

plants in northern Mississippi

an(i western Tennessee that

are inefficient—rleliberately so.

They will generate electricity

at an incremental cost 50% to 70% high-

er than the industi-y's best. Most of the

time,

the production costs of these

spanking new plants will be simply too

high for them to compete.

Eni'on liasn't gone crazy. By build-

ing less efficient plants, it saved a bun-

dle on constniction. It can let the plants

sit idle, then fire them up when prices

rise.

Last June 25, the price of a

megawatt-hour of electricity in parts of

the Midwest soared—briefly^—from $40

to an unprecedented $7,000. With such

volatility, Enron executives figure they

can make money from their so-called

peaking plants even if they operate only

a week or so per year.

What led Em'on executives to this

counterintuitive notion? A revolution-

ary concept in coi-pd'ate finance called

"real options theoiy." In a nutshell, it

says that when the ftiture is highly un-

certain, it pays to have a broad range

of options open. Eni'on's new plants ai-e,

in effect, options: They give it the op-

portunity but not the obligation to pro-

duce electricity. Making money off liigh-

cost power is no easy trick. But by

using real-options theoi-y, Em-on's finan-

cial wizai-ds figure that they can mine

pi-ofits by calculating just the right time

to lTin the plants, considei-ing pi'evailing

power prices and the costs of starting

up and shutting down.

Real-options analysis rewards fiexi-

biiity—and that's what makes it better

than today's standard decision-making

tool, "net present value."

NPV

calculates

the value of a project by predicting its

payouts, adjusting them for risk, and

subtracting the investment outlay. But

by boiling down all the possibilities for

the future into a single scenario, NPV

doesn't account for the ability of execu-

tives to react to new circumstances—for

instance, spend a little up front, see

how things develop, then either cancel

or go full speed ahead.

"AGILITY." The New Economy, which is

marked by rapid change and lots of un-

certainty, cries out for a tool like real

options. These days, says Hewlett-

Packard Co. CEO Lewis E. Platt, "any-

one who tells you they have a 5- or 10-

year plan is probably crazy. This is the

age of scenario planning. You need not

only speed but agility." Real-options

analysis persuades companies to cj'eate

lots of possibilities for themselves—for

instance, by doing spade work on sev-

eral projects at once. As events unfold,

many options won't be worth pui"suing.

But a few could be blockbusters. With

an options approach, "uncertainty has

the potential to be your Mend, not your

enemy," says Paul E. Cîreenberg, a con-

sultant at Analysis Group/Economics in

Cambridge, Mass.

Although conceived more than 20

years ago, real-options analysis is just

now coming Into wide use. Rapid change

has exposed the weaknesses of less fiex-

ible valuation tools. Experts have de-

veloped rules of thumb that simplify

the foiTnidable math behind options val-

uation, while making real options ap-

plicable in a bi'oader range of situations.

And consulting firms have latched on

to the techni(]ue as the Next Big Thing

to sell to clients. "Real-options valua-

tion has the potential to be a major

When the future is highly unpredictable, this theory

says

it

1 18 BiJSmESS WEEK / JUNE 7. 1999