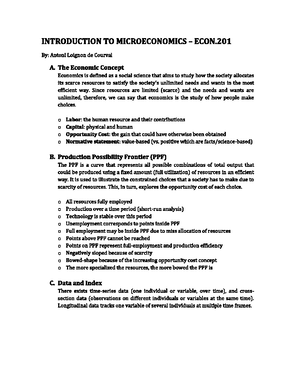

- Information

- AI Chat

Was this document helpful?

Practical - chapter 5 questions & answers

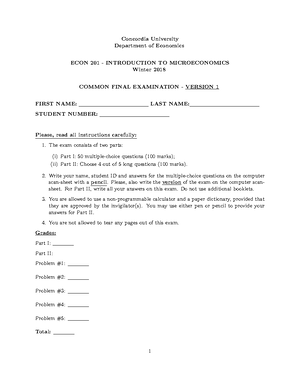

Course: Introduction to Microeconomics (ECON 201)

999+ Documents

Students shared 1711 documents in this course

University: Concordia University

Was this document helpful?

Previous Exam Question & Answer

Ch5

1. The deadweight loss from a price increase resulting from a tax is the loss of

a. Tax revenue from the decreased equilibrium quantity.

b. Producer surplus.

c. Consumer surplus.

d. Consumer surplus minus the loss of producer surplus.

e. Consumer surplus plus the loss of producer surplus (CS loss is the upper , PS loss is the

lower , graphically).

2. A steel mill produces 40,000 tons of steel per month at a cost of $5 million. For the people in the

surrounding community, the production of 40,000 tons of steel causes an increase of $300,000 in

health care expenditures, a loss of $200,000 in wages from being sick, and an increase of $100,000 in

expenditures on home and auto care due to the dirty air. Based on these figures, the private cost of

40,000 tons of steel is ________ while the social cost is ________. (from Aplia)

a. $5 million; $5.6 million. (Notice that social cost = private + external cost)

b. $5 million; $600,000.

c. $5.6 million; $5 million.

d. $600,000; $5.6 million.

3. If flu vaccination generates external benefits for society as a whole (fewer infected, less likely to

spread), then (from Apia)

a. The free market amount of vaccination done is too low.

b. At the free market outcome, the marginal social benefit is greater than the marginal cost.

c. The government can subsidize consumption of the good.

d. Both a and b.

e. All of the above.

4. When economists describe a good as being 'under-priced' and produced at an inefficient level under

free market, they mean that:

a. output should be increased because the marginal social benefit in consumption exceeds

the marginal social cost of production.

b. too much of the good is being produced since there is a negative externality

associated with the good.

c. resources are properly allocated since society wants more of the good at a lower price.

d. there is an under-allocation of resources in the production of the good.

5. The deadweight loss associated with output less than the competitive level can be determined by

a) subtracting the competitive level producer surplus from the producer surplus associated with

less output.

b) subtracting the consumer surplus from the producer surplus associated with less output.

c) summing the consumer and producer surplus associated with less output.

d) summing the change in the total consumer and producer surplus, and the change in

government revenue, from moving from the competitive level of output to a lower

output.