- Information

- AI Chat

Was this document helpful?

Tax Form - A tax form example for the Wills and Admin module

Module: Wills and Administration of Estates

381 Documents

Students shared 381 documents in this course

University: University of Law

Was this document helpful?

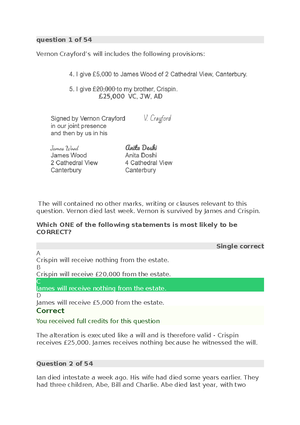

IHT205(2011) Page 1 7002201 HMRC 11/13

When to use this form

Fill in this version of this form only when the person died on

or after 6 April 2011. Fill in this form where the person who

has died (‘the deceased’) was domiciled (had their permanent

home) in the UK at the date of death and the gross value of

the estate for Inheritance Tax is less than or equal to:

• the excepted estate limit

•

twice the excepted estate limit and form IHT217 ‘Claim

to transfer unused nil rate band for excepted estates’ is

attached

• £1,000,000 and there is no Inheritance Tax to pay because

of spouse, civil partner or charity exemption

Keep a copy of this form for your records as HMRC cannot

provide you with a copy at a later date.

Notes

Read the notes in booklet IHT206(2011) to help you fill in

this form.

Help

For more information or help:

• go to www.hmrc.gov.uk/inheritancetax

• phone our helpline on 0300 123 1072

Your rights and obligations

Your Charter explains what you can expect from us

and what we expect from you. For more information go

to www.gov.uk/hmrc/your-charter

About the person who has died About the estate

1.1 Title enter Mr, Mrs, Miss, Ms or other title

1.2 Surname

1.3 First name

1.4 Date of death DD MM YYYY

1.5 Marital or civil partnership status?

Married or in civil partnership

Single

Divorced or former civil partner

Widowed or a surviving civil partner

1.6 Occupation

1.7 National Insurance number if known

2 In the 7 years before they died, did the deceased:

make any gifts or other transfers totalling more than

£3,000 per year, other than normal birthday, festive,

marriage or civil partnership gifts?

No Yes

or

give up the right to benefit from any assets held in trust

that were treated as part of their estate for Inheritance

Tax purposes?

No Yes

If you answered ‘Yes’ to either part of this question,

include the chargeable value of the gifts in box 9.1.

But if this value is more than £150,000 or the assets

do not qualify as ‘specified transfers’, stop filling in this

form. You will need to fill in form IHT400 ‘Inheritance

Tax account’ instead.

Return of estate information

MR

Voss

Jeremy Nigel

2

4

0

6

2

0

2

1

✔

Retired

M

N

5

0

8

9

8

1

H

✔

✔