- Information

- AI Chat

Chapter 4 job costing

Cost-Benefit Analysis (HLS 2981)

Harvard University

Related Studylists

ShamshuPreview text

CHAPTER 4

JOB COSTING

4-1 Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Cost pool––a grouping of individual indirect cost items. Cost tracing––the assigning of direct costs to the chosen cost object. Cost allocation––the assigning of indirect costs to the chosen cost object. Cost-allocation base –– a factor that links in a systematic way an indirect cost or group of indirect costs to cost objects.

4-2 What is the main difference between job costing and process costing? Provide one example for each costing method.

In a job-costing system, costs are assigned to a distinct unit, batch, or lot of a product or service. In a process-costing system, the cost of a product or service is obtained by using broad averages to assign costs to masses of identical or similar units.

Students‘ answers will vary when sharing examples of each.

4-3 Why might an advertising agency use job costing for an advertising campaign by PepsiCo, whereas a bank might use process costing to determine the cost of checking account deposits?

An advertising campaign for Pepsi is likely to be very specific to that individual client. Job costing enables all the specific aspects of each job to be identified. In contrast, the processing of checking account deposits is similar for many customers. Here, process costing can be used to compute the cost of each checking account deposit.

4-4 Explain how you can determine the cost of a cost object/job under job-costing system.

By tracing the cost of direct cost and allocating the cost of indirect cost to a cost object as follows: After identifying the cost object, you can trace the cost of direct cost to it. Then you can select necessary cost-allocation base(s) for all relevant indirect costs, calculate the overhead rate(s) for each cost-allocation base(s), and allocate indirect costs associated with each cost- allocation base(s) to the chosen cost object/job. And finally calculate the total cost of the job by adding all direct traced and all indirect costs allocated to the cost object/job.

4-5 Give examples of two cost objects in companies using job costing.

Major cost objects that managers focus on in companies using job costing are a product such as a specialized machine, a service such as a repair job, a project such as running the Expo, or a task such as an advertising campaign.

4-6 Describe three major source documents used in job-costing systems.

Three major source documents used in job-costing systems are (1) job cost record or job cost sheet, a document that records and accumulates all costs assigned to a specific job, starting when work begins; (2) materials requisition record, a document that contains information about the cost of direct materials used on a specific job and in a specific department; and (3) labor-time sheet, a document that contains information about the amount of labor time used for a specific job in a specific department.

4-7 What is the role of information technology in job costing?

Information technology provides managers with up-to-date, quick and accurate job costing information, and making it quicker and easier for them to manage and control the costs and to make necessary decision(s) if needed.

4-8 Seasonal patterns and fluctuating levels of monthly outputs are the two main factors for most organizations to use an annual period rather than a weekly or a monthly period to compute budgeted indirect-cost rates. Explain how annual indirect rates alleviate the impacts of these two factors.

An annual period eliminates the influence of seasonal patterns in calculating overhead cost rates, and reduces the effect of variations in output levels as one single average overhead rate is calculated for the whole period.

4-9 Distinguish between actual costing and normal costing.

Actual costing and normal costing differ in their use of actual or budgeted indirect cost rates: Actual Costing

Normal Costing Direct-cost rates Indirect-cost rates

Actual rates Actual rates

Actual rates Budgeted rates

Each costing method uses the actual quantity of the direct-cost input and the actual quantity of

the cost-allocation base.

4-10 Explain how job-costing information may be used for decision making.

Job-costing information can be used to determine the profitability of individual jobs, to assist with determining the minimum price for a job in bidding situation, and to help in prioritizing

jobs based on the costs and profits when there are limited resources.

4-11 Comment on the following statement: There is no difference between ―actual costing‖ and ―normal costing‖ systems as both use the product of actual direct-cost rates and actual quantities of direct- cost inputs.

The statement is false. Both ―actual costing‖ and ―normal costing‖ systems are similar only in

a. Finished goods that are purchased by customers will directly impact cost of goods sold. b. Indirect manufacturing labor and indirect materials are part of the actual manufacturing costs incurred. c. Direct materials and direct manufacturing labor are included in total manufacturing costs. d. Manufacturing overhead costs incurred is used to determine total manufacturing costs.

SOLUTION

Choice "d" is correct. Total manufacturing costs contains manufacturing costs applied, not actual manufacturing costs incurred. The application of job order costing may result in over-applied or underapplied overhead because of differences in applied and actual manufacturing overhead.

a. Choice "a" is incorrect. The finished goods that are purchased reduce the finished goods balance and increase the cost of goods sold balance.

b. Choice "b" is incorrect. Both indirect manufacturing labor and indirect materials are accumulated in the actual manufacturing costs incurred.

c. Choice "c" is incorrect. Total manufacturing costs under job order costing include direct materials, direct manufacturing labor and manufacturing overhead applied.

4-17 Sturdy Manufacturing Co. assembled the following cost data for job order #23:

What are the total manufacturing costs for job order #23 if the company uses normal job-order costing? a. $191,500 b. $193, c. $194,500 d. $195,

SOLUTION

Choice "d" is correct. Total manufacturing costs include direct materials, direct manufacturing labor, and manufacturing overhead applied. Actual manufacturing overhead costs incurred were $12,000 (indirect manufacturing labor) + $1,000 (equipment depreciation) + $1,500 (other indirect manufacturing costs) + $4,000 (indirect materials) = $18,500. If manufacturing overhead applied was $2,000 overapplied, then the manufacturing overhead applied was $20,500. Total manufacturing costs: $80,000 (DL) + $95,000 (DM) + $20,500 = $195,

Choice "a" is incorrect. The manufacturing overhead was erroneously underapplied by $2,000 in the calculation.

Choice "b" is incorrect. This calculation used actual manufacturing costs incurred instead of the manufacturing overhead applied amount.

Choice "c" is incorrect. This answer choice treated equipment depreciation as a period expense and not an inventoriable cost as part of the manufacturing overhead (applied) calculation.

4-18 For which of the following industries would job-order costing most likely not be appropriate? a. Small business printing. b. Cereal production. c. Home construction. d. Aircraft assembly.

SOLUTION

Choice "b" is correct. The cereal products business involves the production of a number of homogeneous items. As a result, it is more conducive to the use of process costing than job-order costing.

Choice "a" is incorrect. Job-order costing is conducive to small business printing as a new job order is created (with costs tracked) every time a new job is started.

Choice "c" is incorrect. The construction of new homes would use job-order costing as every home has some unique or specialized feature to it.

Choice "d" is incorrect. The creation and/or assembly of aircraft is conducive to the use of job- order costing given the unique and specialized nature of each aircraft.

4-19 ABC Company uses job-order costing and has assembled the following cost data for the production and assembly of item X:

Based on the above cost data, the manufacturing overhead for item X is: a. $500 overallocated. b. $600 underallocated. c. $500 underallocated d. $600 overallocated.

SOLUTION

Choice "c" is correct. The actual manufacturing overhead costs incurred includes: $4, (indirect manufacturing labor) + $400 (utilities) + $500 (fire insurance) + $6,000 (indirect materials) + $600 (depreciation on equipment) = $11,500. Because actual manufacturing

overhead is the underallocated or overallocated manufacturing overhead. Something eventually has to be done with the total amount of underallocated or overallocated overhead at the end of the year, but that issue is beyond the scope of this question.

Answer 1 is not correct because it erroneously subtracts the cost of indirect materials issued to production ($16,000) from the total manufacturing costs of jobs in November ($620,000).

Answer 2 is incorrect because it calculates the manufacturing costs of jobs as direct materials ($180,000) + direct manufacturing labor ($214,000) + actual manufacturing overhead incurred ($250,000) for a total of $644,000.

Answer 3 is incorrect because it calculates the manufacturing costs of jobs as direct materials ($180,000) + direct manufacturing labor ($214,000) + actual manufacturing overhead incurred ($250,000) + indirect materials issued to production ($16,000) for a total of $660,000.

4-21 (10 min) Job costing, process costing. In each of the following situations, determine whether job costing or process costing would be more appropriate.

a. A hospital l. An advertisement film producer b. A car manufacturer m. A travel agent company c. A computer manufacturer n. A health drink manufacturer d. A road construction firm o. A cost audit firm e. A soap manufacturer p. A boiler manufacturer f. A solicitor firm q. An electric lamp manufacturer g. A glassware manufacturer r. A courier service agency h. A land development company s. A pharmaceutical company i. An event management company t. A cosmetic products manufacturer j. An oil mill u. A cell phone manufacturer k. A wine manufacturer

SOLUTION

(10 min) Job order costing, process costing.

a. Job costing l. Job costing b. Process costing m. Job costing c. Process costing n. Process costing d. Job costing o. Job costing e. Process costing p. Process costing f. Job costing q. Process costing g. Process costing r. Job costing h. Job costing s. Process costing i. Job costing t. Process costing j. Process costing u. Process costing k. Process costing

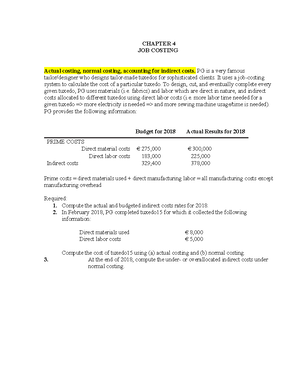

4-22 Actual costing, normal costing, accounting for manufacturing overhead. Carolin Chemicals produces a range of chemical products for industries on getting bulk orders. It uses a job-costing system to calculate the cost of a particular job. Materials and labors used in the manufacturing process are direct in nature, but manufacturing overhead is allocated to different jobs using direct manufacturing labor costs. Carolin provides the following information:

Budget for 2017 Actual Results for 2017 Direct material costs $ 2,750,000 $3,000, Direct manufacturing labor costs 1,830,000 2,250, Manufacturing overhead costs 3,294,000 3,780,

Required: 1. Compute the actual and budgeted manufacturing overhead rates for 2017. 2. During March, the job-cost records for Job 635 contained the following information:

Direct materials used $73, Direct manufacturing labor costs $51,

Compute the cost of Job 635 using (a) actual costing and (b) normal costing. 3. At the end of 2017, compute the under- or overallocated manufacturing overhead under normal costing. Why is there no under- or overallocated overhead under actual costing? 4. Why might managers at Carolin Chemicals prefer to use normal costing?

SOLUTION

(20 min.) Actual costing, normal costing, accounting for manufacturing overhead.

1.

- Costs of Job 635 under actual and normal costing follow:

Direct labor-hours 840 960

Direct materials and direct labor are paid for on a contractual basis. The costs of each are known when direct materials are used or when direct labor-hours are worked. The 2017 actual manufacturing-support costs were $5,355,000 and the actual direct labor-hours were 153,000.

Required: 1. Compute the (a) budgeted indirect-cost rate and (b) actual indirect-cost rate. Why do they differ? 2. What are the job costs of the Steel Wheels and the Magic Wheels using (a) normal costing and (b) actual costing? 3. Why might Caldwell Toys prefer normal costing over actual costing?

SOLUTION

(20 -30 min.) Job costing, normal and actual costing.

1.

These rates differ because both the numerator and the denominator in the two calculations are different—one based on budgeted numbers and the other based on actual numbers.

2a. Steel Wheels Magic Wheels Normal costing Direct costs Direct materials $78,290 $94, Direct labor $25,445 $32, 103,735 127,402.

Indirect costs Manufacturing support ($34 × 840; $34 × 960) 28,560 32, Total costs $132,295 $160,

2b. Actual costing Direct costs Direct materials $78,290 $94, Direct labor 25,445 32, 103,735 127, Indirect costs Manufacturing support ($35 × 840; $35 × 960) 29,400 33, Total costs $133,135 $161,

- Normal costing enables Caldwell to report a job cost as soon as the job is completed, assuming that both the direct materials and direct labor costs are known at the time of use. Once the 840 direct labor-hours are known for the Steel Wheels (Jan–May 2017), Caldwell can compute the $132,295 cost figure using normal costing. Caldwell can use this information to manage the costs of the Steel Wheels job as well as to bid on similar jobs later in the year. In contrast, Caldwell has to wait until the December 2017 year-end to compute the $133,135 cost of the Steel Wheels using actual costing. The following overview diagram summarizes Caldwell Toy‘s job-costing system:

INDIRECT COST POOL

COST ALLOCAT ION BASE

Direct Materials

COST OBJECT : RESIDENT IAL HOME

DIRECT COST S

ManufacturingDirect

Labor

Indirect Costs Direct Costs

Assembly Support

Direct Labor-Hours

Manufacturing support

4-25 Job costing, accounting for manufacturing overhead, budgeted rates. The Lynn Company uses a normal job-costing system at its Minneapolis plant. The plant has a machining department and an assembly department. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and two manufacturing overhead cost pools (the machining department overhead, allocated to jobs based on actual machine-hours, and the assembly department overhead, allocated to jobs based on actual direct manufacturing labor costs). The 2014 budget for the plant is as follows: Machining Department Assembly Department Manufacturing overhead $1,800,000 $3,600, Direct manufacturing labor costs $1,400,000 $2,000, Direct manufacturing labor-hours 100,000 200, Machine-hours 50,000 200,

[Required] 1. Present an overview diagram of Lynn‘s job-costing system. Compute the budgeted manufacturing overhead rate for each department. 2. During February, the job-cost record for Job 494 contained the following:

Machining Department Assembly Department Direct materials used $45,000 $70, Direct manufacturing labor costs $14,000 $15, Direct manufacturing labor-hours 1,000 1, Machine-hours 2,000 1,

Compute the total manufacturing overhead costs allocated to Job 494.

At the end of 2014, the actual manufacturing overhead costs were $2,100,000 in machining and $3,700,000 in assembly. Assume that 55,000 actual machine-hours were used in machining and that actual direct manufacturing labor costs in assembly were $2,200,000. Compute the over- or underallocated manufacturing overhead for each department.

SOLUTION

(20-30 min.) Job costing, accounting for manufacturing overhead, budgeted rates.

- An overview of the product costing system is

COST OBJECT: PRODUCT

COST ALLOCATION BASE

DIRECT COST

Machining Department Manufacturing Overhead

Machine-Hours

Direct Materials

INDIRECT COST POOL

Direct Manufacturing Labor

Indirect Costs Direct Costs

Assembly Department Manufacturing Overhead

Direct Manuf. Labor Cost

Budgeted manufacturing overhead divided by allocation base:

Machining Department overhead: 50 , 000

,1$ 800 , 000

= $36 per machine-hour

Assembly Department overhead: ,2$ 000 , 000

,3$ 600 , 000

= 180% of direct manuf. labor costs

Machining department overhead allocated, 2,000 hours $36 $72, Assembly department overhead allocated, 180% $15,000 27, Total manufacturing overhead allocated to Job 494 $99,

Machining Dept. Assembly Dept. Actual manufacturing overhead $2,100,000 $ 3,700, Manufacturing overhead allocated, $36 55,000 machine-hours 1,980,000 — 180% $2,200,000 — 3,960,

Underallocated (Overallocated) $ 120,000 $ (260,000)

4-26 Job costing, consulting firm. Global Enterprize, a management consulting firm, has the following condensed budget for 2017: Revenues $42,000, Total costs: Direct costs Professional labor $15,000, Indirect costs Client support 22,170,000 37,170, Operating income $ 4,830,

- At the budgeted revenues of $42,000,000 Global Enterprize‘s operating income of $4,830,000 equals 11% of revenues.

Markup rate = $42,000,000 ÷ $15,000,000 = 280% of direct professional labor costs

- Budgeted costs Direct costs: Director, $175 8 $ 1, Partner, $80 20 1, Associate, $40 75 3, Assistant, $25 180 4,500 $10, Indirect costs: Consulting support, 147% $10,500 15, Total costs $26,

As calculated in requirement 2, the bid price to earn an 11% income-to-revenue margin is 280% of direct professional costs. Therefore, Global Enterprize should bid 2 $10,500 = $29,400 for the Horizon Telecommunications job. Bid price to earn target operating income-to-revenue margin of 11% can also be calculated as follows:

Let R = revenue to earn target income R – 0 = $26,

COST ALLOCATION BASE

Consulting Support

Consulting Support

COST OBJECT: JOB FOR CONSULTING CLIENT

DIRECT

COSTS

Indirect Costs Direct Costs

INDIRECT COST POOL

Professional Labor Costs

Professional Labor Costs

Professional Labor

0 = $26,

R = $29,019 ÷ 0 = $29,

Or Direct costs $10, Indirect costs 15, Operating income (0 $29,400) 3, Bid price $29,

4-27 Time period used to compute indirect cost rates. Plunge Manufacturing produces outdoor wading and slide pools. The company uses a normal-costing system and allocates manufacturing overhead on the basis of direct manufacturing labor-hours. Most of the company‘s production and sales occur in the first and second quarters of the year. The company is in danger of losing one of its larger customers, Socha Wholesale, due to large fluctuations in price. The owner of Plunge has requested an analysis of the manufacturing cost per unit in the second and third quarters. You have been provided the following budgeted information for the coming year:

Quarter 1 2 3 4 Pools manufactured and sold 565 490 245 100

It takes 1 direct manufacturing labor-hour to make each pool. The actual direct material cost is $14 per pool. The actual direct manufacturing labor rate is $20 per hour. The budgeted variable manufacturing overhead rate is $15 per direct manufacturing labor-hour. Budgeted fixed manufacturing overhead costs are $12,250 each quarter.

Required: 1. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on the budgeted manufacturing overhead rate determined for each quarter. 2. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on an annual budgeted manufacturing overhead rate. 3. Plunge Manufacturing prices its pools at manufacturing cost plus 30%. Why might Socha Wholesale be seeing large fluctuations in the prices of pools? Which of the methods described in requirements 1 and 2 would you recommend Plunge use? Explain.

SOLUTION

(15–20 min.) Time period used to compute indirect cost rates.

- Quarter 1 2 3 4 Annual (1) Pools sold 565 490 245 100 1, (2) Direct manufacturing 565 490 245 100 1,

Price based on annual budgeted manufacturing overhead rates calculated in requirement 2 ($84 130%; $84 130%) $109 $109.

Socha might be seeing large fluctuations in the prices of its pools because Plunge is determining budgeted manufacturing overhead rates on a quarterly rather than an annual basis. Plunge should use the budgeted annual manufacturing overhead rate because capacity decisions are based on longer annual periods rather than quarterly periods. Prices should not vary based on quarterly fluctuations in production. Plunge could vary prices based on market conditions and demand for its pools. In this case, Plunge would charge higher prices in quarter 2 when demand for its pools is high. Pricing based on quarterly budgets would cause Plunge to do the opposite—to decrease rather than increase prices!

4- 28 Accounting for manufacturing overhead. Holland Woodworking uses normal costing and allocates manufacturing overhead to jobs based on a budgeted labor-hour rate and actual direct labor-hours. Under- or overallocated overhead, if immaterial, is written off to cost of goods sold. During 2014, Holland recorded the following:

Budgeted manufacturing overhead costs $4,400, Budgeted direct labor-hours 200, Actual manufacturing overhead costs 4,650, Actual direct labor-hours 212,

Required: 1. Compute the budgeted manufacturing overhead rate. 2. Prepare the summary journal entry to record the allocation of manufacturing overhead. 3. Compute the amount of under- or overallocated manufacturing overhead. Is the amount significant enough to warrant proration of overhead costs, or would it be permissible to write it off to cost of goods sold? Prepare the journal entry to dispose of the under- or overallocated overhead.

SOLUTION

(10–15 min.) Accounting for manufacturing overhead.

- Budgeted manufacturing overhead rate =

$4, 400, 000

200,000 labor-hours

= $22 per direct labor-hour

Work-in-Process Control 4,664, Manufacturing Overhead Allocated 4,664, (212,000 direct labor-hours $22 per direct labor-hour = $4,664,000)

$4,650,000– $4,664,000 = $74,000 overallocated, an insignificant amount of difference compared to manufacturing overhead costs allocated $14,000 ÷ $4,664,000 = 0%. If the quantities of work-in-process and finished goods inventories are small, the difference between proration and write off to Cost of Goods Sold account would be very small compared to net income. Manufacturing Overhead Allocated 4,664, Manufacturing Department Overhead Control 4, Cost of Goods Sold 14,

4-29 Job costing, journal entries. The University of Chicago Press is wholly owned by the university. It performs the bulk of its work for other university departments, which pay as though the press were an outside business enterprise. The press also publishes and maintains a stock of books for general sale. The press uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs).

The following data (in thousands) pertain to 2017:

Required:

Prepare an overview diagram of the job-costing system at the University of Chicago Press.

Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of the year-end under- or overallocated manufacturing overhead as a write-off to Cost of Goods Sold. Number your entries. Explanations for each entry may be omitted.

Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated.

How did the University of Chicago Press perform in 2017?

The term manufacturing overhead is not used uniformly. Other terms that are often encountered in printing companies include job overhead and shop overhead.

Chapter 4 job costing

Course: Cost-Benefit Analysis (HLS 2981)

University: Harvard University

- Discover more from: