- Information

- AI Chat

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Was this document helpful?

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

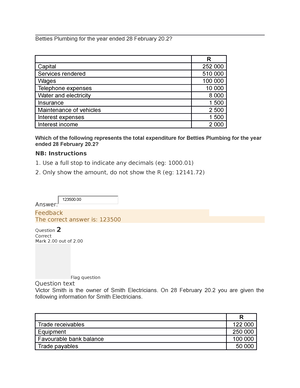

My Modules FAC1502-21-S1-17E Online Assessment

Course: Financial Accounting Principles (FAC1502)

489 Documents

Students shared 489 documents in this course

University: University of South Africa

Was this document helpful?

This is a preview

Do you want full access? Go Premium and unlock all 11 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

7/16/2021

myModules : FAC1502-21-S1-17E : Online Assessment

https://mymodules.unisa.ac.za/portal/site/FAC1502-21-S1-17E/tool/490667e1-50ec-42f9-9aff-20980454cdbe/jsf/index/mainIndex

1/11

1.0/ 1.0 Points

1.0/ 1.0 Points

1.0/ 1.0 Points

1.0/ 1.0 Points

2 ASSIGNMENT 2.0

RETURN TO ASSESSMENT LIST

Part 1 of 4 - 3.0/ 3.0 Points

Question 1 of 20

Indicate by choosing the correct option whether the following statement is true or false:

At the end of the financial year, an allowance for credit losses will be subtracted from the trade receivables

balance and an allowance for settlement discount granted will be added to the trade receivable balance.

Thereafter the net amount will be disclosed under trade and other receivables in the statement of financial

position.

True

False

Answer Key: False

Question 2 of 20

Indicate by choosing the correct option whether the following statement is true or false:

At the end of the financial year, an allowance for credit losses will be used to increase the trade receivables

balance and the aggregate amount will be disclosed under trade and other receivables in the statement of

financial position.

True

False

Answer Key: False

Question 3 of 20

The total of the trade receivables control account in the cash receipts journal will be posted to the

debit side of the trade receivable control account in the general ledger.

True

False

Answer Key: False

Part 2 of 4 - 7.0/ 9.0 Points

Question 4 of 20

Which of the following will be considered as the source document for recording transactions in

the cash receipts journal?

A. Original credit note

B. Duplicate credit note

myModules

myAdmin

FAC1502-21-S1-17E / Online Assessment

Online Assessment

Online Assessment

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.