- Information

- AI Chat

Topic 3

Financial Accounting

Universiti Tunku Abdul Rahman

Related Studylists

land lawPreview text

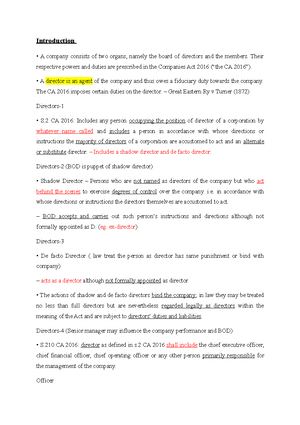

Promoter - I

Definition: •A promoter is one who undertakes to form a company with reference to a given project, and to set it going, and who takes the necessary steps to accomplish that purpose. Thus, where a person who is already carrying on business decides to expand the business and incorporate the company and use it as a means to conduct a business.

- Twycross v Grant (1877) 2 CPD 469 as per Cockburn CJ •A promoter is one who starts off a venture – any venture – not solely for himself, but for others, of whom he may be one’

- Tengku Abdullah ibni Sultan Abu Bakar v Mohd Latiff bin Shah Mohd (1996) 2 MLJ 265 as per Gopal Sri Ram JCA

•Meaning: a. Person who undertakes steps to form a company and take the premelitary step to form the coorperation

- Tengku Abdullah ibni Sultan Abu Bakar v Mohd Latiff bin Shah Mohd [1996] 2 MLJ 265; b. s(1) Companies Act 2016 –Person who is involved in preparing prospectus

–Professionals (eg. lawyers or accountants) who prepare documents for co formation are not promoters. c. Person who is a party to pre-incorporation contract. –Even if the person did not take an active part but he benefited from forming the co, he can be considered as a promoter ‘passive promoter’

- Tracy v Mandalay Pty Ltd (1953) 88CLR 215.

–A promoter of a registered company can be either a natural person or an artificial person •eg. setting up of a wholly owned subsidiary by a holding company.

Promoter’s Duties - I

•Promoter is ‘one who undertakes to form a company with reference to a given subject and to set it going and who takes all the necessary steps to accomplish that purpose.‘

•The promoter lays the foundations for a Company in terms of negotiations, registration of the Company, obtaining directors and shareholders and preparing all the paperwork.

•Because the Promoter is such an important person in the formation of the company, the law places several responsibilities on him. These are known as fiduciary duties

•A Promoter is in a fiduciary(trust and duties) relationship with the Company he promotes and as such he owes fiduciary duties towards it. This means that he is in a position of trust and must at all times act honestly and in good faith for the Company as a whole.

•Promoter owes a fiduciary duty to the company.

- Erlanger V New Sombrero Phosphate Co (1878) 3 App Cas 1218

The promoters (Erlanger and his syndicate) bought a lease of an island to mine phosphate for £55,000 and then incorporated the New Sombrero Phosphate Co.

Habib Abdul Rahman v Abdul Cader (1808-1890) 4 Ky 193.

•A promoter who is also shareholder –Must be full disclosure and not partial disclosure

Gluckstein v Barnes [1900] AC 240.

•The four promoters acquired a property at £140,000 and then sold it at £180,000 to a company which they subsequently incorporated. The prospectus inviting applications for share contained information about the £40,000 profit they mad on the sale. However, the promoters had also acquired securities on the property at a discounted price which they sold at market value and they made a profit of £20,000. This was not disclosed to the company. The company went into liquidation four years later and an action was brought against G for the recovery of his portion of the profits. G argued that there was sufficient disclosure made by him through the prospectus.

Held: The disclosure was not effective unless it was made fully and frankly. The court stated that: ‘Disclosure’ is not the most appropriate word to use where a person who plays many parts announces to himself in one character what he has done and is doing in another. To talk of disclosure to the thing called the company, when as yet there were no shareholders, is a mere farce. To the intended shareholders there was no disclosure at all. (Per Lord MacNaghten)

A duty to account to the company for the benefit for any property he might purchase with the intent of selling the property to Company for a profit later. (the promoter buy with RM30k the property and sell it to company with RM40k)

A duty not to defraud the Company by active concealment of any affairs relating to the company

A duty not to disclose confidential information to outsiders (interlectual property- idea, Blue Ocean strategy)

A duty not to hide his personal interests through a nominee (proxy-third party) Promoters

Entrepreneurs may come together to form a company to carry on their business. They may take or instruct others to take the steps required by law to incorporate a company. They are known as the promoters of the company.

Include persons who are forming a company to run a business, or, as in Salomon’s case, where the promoter sells his own business to the new company, or make arrangements to float a company already in existence, and offer the shares of that company to others.

Solicitors and accountants who are employed in their professional capacity to incorporate a company are not necessarily

duty to act in the utmost good faith. This means that a promoter has a:

- Duty to make full disclosure

- Promoters have a duty to make full disclosure of the transactions he had entered into on behalf of the company to allow the company to either accept the contract or not.

- The duty is fulfilled upon disclosure of the entire truth done before an independent board of directors. Disclosure by a promoter of the partial truth is insufficient as it would be defective and lacking in any legal force.

Disclosure must be full, frank, and explicit, and contain all the information relevant to the transaction.

Gluckstein v Barnes: The defendants bought debentures at a reasonable price in a company, and later bought over the company for £140,000. The debentures were redeemed at full value and they made a profit of £20,000. The defendants then formed another company, which they were directors of, and sold the former company to the new company at a profit of £40,000. This was disclosed in the company’s prospectus, but not the £20,000 profit they made on the redemption of the debentures. The company went into liquidation, and the liquidator tried to recover the undisclosed profits received.

House of Lords held: The partial disclosure of the profits gained was not sufficient as it did not amount to a full disclosure, and therefore the profits made were recoverable by the liquidator. What amounts to disclosure is communication to an independent board of directors, or existing and future shareholders. The test in determining whether a board is independent, as in Erlanger v New Sombrero Phosphate Co. is to see whether the board is competent to form an impartial, independent and intelligent judgment on the merits of the transactions. The appellant and his friends formed a syndicate to acquire a lease of an island for mining phosphate. A company was formed by the members of the syndicate to purchase the lease. The board of directors of the company which was nominated by the head of the syndicate ratified the contract. The phosphate business then failed and the board of directors were removed by the members. A new board was appointed and took action to rescind the contract to purchase the lease. House of Lords held: The disclosure made by the promoters was not to an independent board of directors, and therefore the contract could be rescinded. A local case that upholds the same principle with regard to the duty of disclosure of promoters is the case of Habib Abdul Rahman v Abdul Cader [1808 – 1890] 4 Ky 193; The company that was promoted by Abdul Cader and another person bought a piece of land from another company. This land was divided and offered for sale to the public. Abdul Cader set up a partnership with three others and bought one lot. He did not disclose that he had an interest in the purchase. The other shareholders sought to have the sale rescinded on the grounds of his failure to disclose his interest. The court held that the fact that the promoter did not disclose his interest when he bought the land from the company he had promoted was grounds to allow rescission of the contract. 2. Duty not to make secret profits

Held: The failure of the promoter to disclose the promise of payment of commission, makes him liable for the money had it been paid over to him. Although he had not received the commission promised, the company could recover the unpaid balance of the secret commission.

Remedies for Breach of Duties - I

- Rescission (Stop the contract) •If the Company has entered into a Contract with the promoter and it is later discovered there had been no transparency (no hidden), the Company is entitled to rescind the contract. It is irrelevant that the promoter has made no profit from the contract.

- S Contracts Act 1950 states that non-disclosure amounts(equal) to a fraud and by S, the contract becomes voidable.

Under S. 34(1) Specific relief Act 1950, the Company can apply to the Court to rescind the contract. Once the contract is rescinded, restitution (return ,restore) has to take place. This is where the Company has to return whatever it received from the Promoter and the Promoter has to return all monies received from the company. Erlanger v New Sombrero Phosphate Co. (1878) The Court held that there had been no adequate disclosure of the circumstances of the sale and the Company was entitled to rescind the contract. 2. Recovery of the secret profit The company may elect to ratify the contract and recover the profit that has been made. This include any amount that is promised to the promoter.

- Gluckstein V Barnes. The court held that there were in breach of their duties as promoters and the Company was entitled to recover the profit from them. The Company can recover the secret profit even though they chose not to rescind the

contract. The liability of the promoters is "joint or several". A Promoter who is found liable may recover contributions from the other promoters. 3. Damages for breach of fiduciary duties

- Re Leeds & Hanley Theatres of Varieties Ltd (1902) The Court ordered the Promoter to pay damages to the Company. The Court held that the Promoters had fraudulently omitted to disclose the profit made by t hem on the sale of the property to the Company. The amount of damages was equivalent to the amount of profit made by the promoters.

Pre-Incorporation Contract (PIC) - I

- S Companies Act 2016

(1) Pre-Incorporation Contract •A contract entered into by a promoter on behalf of the company before it is incorporated for the purpose of securing some benefits for the company.

•This type of contract is known as pre-incorporated contract (PIC).

•PIC has the effect as a contract and the person who entered into such contract is personally liable.

(2) PIC may be ratified by the company after its incorporation and the company shall be bound by the PIC as if the company had been in existence at the date of transaction and had been a party to it. •If co ratified PIC, co is bound.

•Ratification can be express (verbal/ written) / implied (utilize the equipment yet giving any ratification action) and by the BOD/GM

- Cosmic Insurance Corporation v Khoo Chiang Poh [1981] 1 MLJ 61. •The Privy Council allowed an implicit ratification of a contract although it was made subject to certain other specific conditions than was originally agreed

Ltd. had not been incorporated. Leopold Newborne (London) Ltd. was later incorporated and it brought an action against S. That action was dismissed because Leopold Newborne (London) Ltd. had not been incorporated at the time the contract was entered into. •Leopold Newborne then sued S in his own name seeking to enforce the pre- incorporation contract on the basis that he was a party to the contract himself. The argument was made on the basis of Kelner v. Baxter saying that if the contract was not with Leopold Newborne (London) Ltd. then it must have been with the person who signed on behalf of the company, namely, Leopold Newborne.

•The English Court of Appeal held that the correct approach was a rule of construction approach. The real test was whether the promoter was intended, in the circumstances, to be a party to the contract or not. It was held that given the way in which the contract was signed by Leopold Newborne it was intended to be a contract with the company and only the company. In other words, given the way in which it was signed it indicated that it was not intended that Leopold Newborne be a party to the contract himself. Thus Leopold Newborne could not enforce the contract in his own name. •If no ratification, promoter is bound – S(2).

•If there is ‘agreement to the contrary’ promoter is not bound – S(2). –it must be express and not implied – Phonogram Ltd v Lane (1982) 1 QB 938. •A rock group intended to perform under the name "Cheap Mean and Nasty" and to form a company for the purpose to be called "Fragile Management Ltd". Mr Lane accepted a cheque from Phonogram for £6,000, signing his name "for and on behalf of Fragile Management Ltd". The money was to be used to finance production of an album and was repayable if this was not achieved. When the album was not produced, Phonogram sought to recover the money

from Lane, the company having not been in existence at the time the contract was made. •Lane argued that his signature "for and on behalf of" the company amounted to an agreement that he was not to be personally liable on it - an "agreement to the contrary" in terms of s. (Then s(2) of the European Communities Act 1972). •Held: This was not sufficient to exclude the operation of the section, which would be given full effect unless there was a clear and express exclusion of personal liability. Lane was thus liable to repay the money.

Incorporating the Company - I

•A company having a share capital may be incorporated as:

- A private company or

–A public company. •The requirements to form a company: –i. one or more members, having limited or unlimited liability for the obligations of the company and one or more directors.

–ii. S CA 2016- Company limited by shares, a company shall have one or more shares

Incorporating the Company - II –iii. A company secretary who can be either: •a. an individual who is a member of a professional body prescribed by the Minister of Domestic Trade and Consumer Affairs; or

•b. an individual licensed by the Companies Commission of Malaysia (“SSM”). •Both the director and company secretary shall have their principal or only place of residence within Malaysia.

- s CA 2016- A company is incorporated from the date of incorporation stated in the notice of registration and is a legal person separate from its members, continues in existence until removed from the register, and has all the powers of a body corporate.

Companies Commission of Malaysia •Governed by Companies Commission of Malaysia Act 2001.

•Responsible for administration and enforcement of Companies Act 2016.

Securities Commission •Governed by Securities Commission Act 1993.

•Oversee the development of capital market.

•Regulate capital market and ensure its systematic development.

•Administer and enforce Securities Industry Act 1983, Securities Industry (Central Depositories) Act 1991, Futures Industry Act 1993 and Securities Commission Act 1993.

Bursa Malaysia •A forum for buyers and sellers of listed co securities to come together and engage in trading activity i. stock exchange.

•Managed by Bursa Malaysia Securities Bhd which is a subsidiary of Bursa Malaysia Bhd

Foreign Investment Committee •Formulate policy guidelines on foreign investment in all economic sectors.

•Coordinate and regulate acquisition of assets or interests, mergers and takeovers of cos in Malaysia.

•Monitor, assess and evaluate form, context and conduct of foreign investment in Malaysia.

Summary •The law is quite strict on promoters to ensure that he does not take advantage when forming a company at the expense of stakeholders.

•The law has made it clearer as to who is bound by PIC to the advantage of the other party of the PIC.

•Various bodies are formed to carry different roles and functions to ensure business persons do not misuse the company

Topic 3

Course: Financial Accounting

University: Universiti Tunku Abdul Rahman

- Discover more from:Financial AccountingUniversiti Tunku Abdul Rahman261 Documents

- More from:Financial AccountingUniversiti Tunku Abdul Rahman261 Documents