- Information

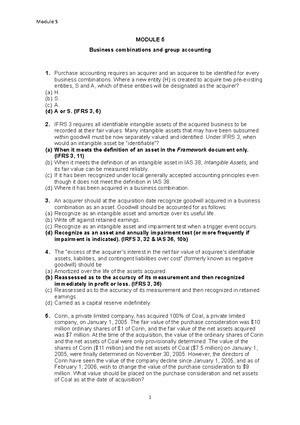

- AI Chat

Quiz 2020, questions and answers

BS in Accountancy

Saint Mary's University Philippines

Recommended for you

Related documents

Preview text

CEBU CPAR CEtfTER, Cebu-CPAR

1

AUDIT OF RECEIVABLES

PROBLEM NO. 1

Your audit disclosed that on December 31, 2006, the accounts receivable control account of Alilem Company had a balance of P2,865,000. An analysis of the accounts receivable account showed the following:

Accounts known to be worthless P 37, Advance payments to creditors on purchase orders 150, Advances to affiliated companies 375, Customers’ accounts reporting credit balances arising from sales return (225,000) Interest receivable on bonds 150, Other trade accounts receivable – unassigned 750, Subscriptions receivable for common stock due in 30 days 825 , Trade accounts receivable - assigned (Finance company’s equity in assigned accounts is P150,000) 375, Trade installment receivable due 1 – 18 months, including unearned finance charges of P30,000 330, Trade receivables from officers due currently 22, Trade accounts on which post-dated checks are held (no entries were made on receipts

of checks) 75,

P2,865,

Questions:

Based on the above and the result of your audit, determine the adjusted balance of following:

1. The trade accounts receivable as of December 31, 2006 is

a. P1,147,500 c. P1,485, b. P1,522,500 d. P1,447,

2. The current trade and other receivables net as of December 31, 2006 is a.

P2,647,500 c. P2,272, b. P2,610,000 d. P1,822,

3. How much of the foregoing will be presented under noncurrent assets as of December 31, 2006? a.

P1,200,000 c. P525, b. P 375,000 d. P 0

Suggested Solution:

Question No. 1

Other trade accounts receivable – unassigned P 750, Trade accounts receivable - assigned 375, Trade installment receivable due 1 – 18 months, net of unearned finance charges of P30,000 300, Trade receivables from officers due currently 22,

Trade accounts on which post-dated checks are held 75,

Trade accounts receivable P1,522,

Question No. 2

Trade accounts receivable (see no. 1) P1,522, Advance payments to creditors on purchase orders 150, Interest receivable on bonds 150,

Subscriptions receivable, due in 30 days 825,

Current trade and other receivables P2,647,

Question No. 3

Advances to affiliated companies P375,

Note: Advances to affiliated companies are normally presented under noncurrent assets.

Answers: 1) B; 2) A; 3) B

Cebu CPAR Center, Inc. Cebu-CPAR

2

PROBLEM NO. 2

Your audit of Banayoyo Corporation for the year ended December 31, 2006 revealed that the Accounts Receivable account consists of the following:

Trade accounts receivable (current) P3,440, Past due trade accounts 640, Uncollectible accounts 128, Credit balances in customers’ accounts (80,000) Notes receivable dishonored 240, Consignment shipments – at cost The consignee sold goods costing P96,000 for P160,000. A 10% commission was charged by the consignee and remitted the balance to

Banayoyo. The cash was received in January, 2007. 320,

Total P4,688,

The balance of the allowance for doubtful accounts before audit adjustment is a credit of P80,000. It is estimated that an allowance should be maintained to equal 5% of trade receivables, net of amount due from the consignee who is bonded. The company has not provided yet for the 2006 bad debt expense.

Questions:

Based on the above and the result of your audit, determine the adjusted balance of following:

Trade accounts receivable a. P4,080,000 c. P4,464, b. P3,440,000 d. P3,584,

Allowance for doubtful accounts a. P204,000 c. P172, b. P216,000 d. P179,

Doubtful accounts expense a. P264,000 c. P252, b. P220,000 d. P227,

Suggested Solution:

Question No. 1

Trade receivables (current) P3,440, Past due trade accounts 640, Notes receivable dishonored 240,

Consignment goods already sold (P160,000 x 90%) 144,

Adjusted trade receivables P4,464,

Question No. 2

Adjusted trade receivables P4,464,

Less due from consignee 144,

Basis of allowance for doubtful accounts 4,320,

Bad debt rate 5%

Required allowance for doubtful accounts P 216,

Question No. 3

Required allowance for doubtful accounts P216, Add write-off of uncollectible accounts 128, Total 344, Less allowance account before adjustment 80, Doubtful accounts expense P264, Answers: 1) C; 2) B; 3) A

PROBLEM NO. 3

Presented below are a series of unrelated situations. Answer the following questions relating to each of the independent situations as requested.

1. Bantay Company’s unadjusted trial balance at December 31, 2006, included the following accounts:

Debit Credit Accounts receivable P1,000, Allowance for doubtful accounts 40, Sales P15,000, Sales returns and allowances 700,

Question No. 4

Bad debt expense for 2006 P840, Customer accounts written off as uncollectible during 2006 (240,000 ) Allowance for doubtful accounts, 12/31/06 P600,

Accounts receivable, net of allowance for doubtful accounts P 9,500,

Allowance for doubtful accounts, 12/31/06 600,

Accounts receivable, before deducting allowance for doubtful accounts P10,100, Question No. 5 Accounts receivable P4,100,

Percentage 3 %

Bad debt expense, before adjustment 123,

Allowance for doubtful accounts (debit balance) 100,

Bad debt expense for 2006 P 223,

Answers: 1) C; 2) A; 3) D; 4) A, 5) C

PROBLEM NO. 4

The adjusted trial balance of Galimuyod Company as of December 31, 2005 shows the following: Debit Credit Accounts receivable P1,000, Allowance for bad debts P40,

Additional information:

Cash sales of the company represents 10% of gross sales.

90% of the credit sales customers do not take advantage of the 2/10, n/30 terms.

It is expected that cash discount of P6,000 will be taken on accounts receivable outstanding at

December 31, 2006.

Sales returns in 2006 amounted to P400,000. All returns were from charge sales.

During 2006, accounts totaling to P44,000 were written off as uncollectible; bad debt recoveries

during the year amounted to P3,000.

The allowance for bad debts is adjusted so that it represents certain percentage of the outstanding

accounts receivable at year end. The required percentage at December 31, 2006 is 150% of the rate used on December 31, 2005.

Questions:

Based on the above and the result of your audit, answer the following:

1. The accounts receivable as of December 31, 2006 is

a. P3,000,000 c. P 333, b. P 300,000 d. P2,444,

2. The allowance for doubtful accounts as of December 31, 2006 is a.

P 20,000 c. P180, b. P120,000 d. P146,

3. The net realizable value of accounts receivable as of December 31, 2006 is a.

P 307,340 c. P2,874, b. P2,814,000 d. P2,291,

4. The doubtful account expense for the year 2006 is a.

P181,000 c. P 21, b. P121,000 d. P147,

Suggested Solution:

Question No. 1

Expected cash discounts P 6,

Divide by percentage of cash discount 0.

Portion of AR that will be granted cash discounts 300, Divide by percentage of total AR estimated to take

advantage of the discount 0.

Accounts receivable, 12/31/06 P3,000,

Qu

Question No. 3 Accounts receivable, 12/31/06 P3,000, Less: Allowance for doubtful accounts P180,

Allowance for sales discounts 6,000 186,

Net realizable value, 12/31/06 P2,814, Question No. 4 Allow. for doubtful accounts, 12/31/06 P180,

Add accounts written off 44,

Total 224, Less: Allow. for doubtful accounts, 12/31/05 P40,

Bad debt recoveries 3,000 43,

Doubtful accounts expense for 2006 P181,

Answers: 1) A; 2) C; 3) B; 4) A

PROBLEM NO. 5

In your audit of Lidlidda Plastic Products Co., you noted that the company’s balance sheet shows the accounts receivable balance at December 31, 2005 as follows: Accounts receivable P3,600,

Allowance for doubtful accounts 72,

P3,528,

During 2006, transactions relating to the accounts were as follows:

Sales on account, P38,400,000.

Cash received from collection of current receivable totaled P31,360,000, after discount of P640,

were allowed for prompt payment.

Customers’ accounts of P160,000 were ascertained to be worthless and were written off.

Bad accounts previously written off prior to 2005 amounting to P40,000 were recovered.

The company decided to provide P184,000 for doubtful accounts by journal entry at the end of the

year.

Accounts receivable of P5,600,000 have been pledged to a local bank on a loan of P3,200,000.

Collections of P1,200,000 were made on these receivables (not included in the collections previously given) and applied as partial payment to the loan.

Questions:

Based on the above and the result of your audit, answer the following:

1. The accounts receivable as of December 31, 2006 is

a. P8,680,000 c. P4,240, b. P9,840,000 d. P8,640,

2. The allowance for doubtful accounts as of December 31, 2006 is a.

P 8,000 c. P184, b. P136,000 d. P176,

3. The net realizable value of accounts receivable as of December 31, 2006 is a.

P8,544,000 c. P8,504, b. P8,456,000 d. P4,104,

4. If receivables are hypothecated against borrowings, the amount of receivables involved should be

a. Disclosed in the statements or notes

b. Excluded from the total receivables, with disclosure

c. Excluded from the total receivables, with no disclosure

d. Excluded from the total receivables and a gain or loss is recognized between the face value and

the amount of borrowings

estion No. 2 Accounts receivable, 12/31/06 P3,000, Multiply by bad debt rate [(P40,000/P1,000,000)

x 1] 0.

Allowance for doubtful accounts, 12/31/06 P 180,

Definitely bad P 48, Doubtful (estimated to be 50% collectible) 24, Apparently good, but slow (estimated to be 90% collectible) 80,000 Total P152,

QUESTIONS:

Based on the above and the result of your audit, answer the following:

1. How much is the adjusted balance of Accounts Receivable as of December 31, 2006? a.

P818,000 c. P832, b. P846,000 d. P826,

2. How much is the adjusted balance of the Allowance for Doubtful Accounts as of December 31, 2006?

a. P30,680 c. P30, b. P31,240 d. P30,

3. How much the Doubtful Accounts expense for the year 2006? a.

P74,680 c. P74, b. P75,240 d. P74,

Suggested Solution:

Question No. 1

SL GL Debit Credit 0 to 1 1 to 6 Over 6 Unadjusted balances 848,000 880,000 40,000 360,000 368,000 152, Add (deduct): Accounts w/ credit balances 26,000 (14,000) (40,000) (14,000) Definitely uncollectible accounts (48,000) (48,000) (48,000)

Unlocated difference (8,000)

Adjusted balances 818,000 818,000 0 360,000 354,000 104,

Question No. 2

Account classification

Adjusted balance Rate

Required Allowance 0 to 1 month P360,000 1% P 3, 1 to 6 months 354,000 2% 7, Over 6 months 104,000 P24,000 – 50% 12,

P80,000 – 10% 8,

P30,

Question No. 3

Doubtful account expense, per books P48, Add adjustment to allowance: Required allowance P30, Less balance before required

allowance (P52,000 – P48,000) 4,000 26,

Doubtful Accounts expense for 2006 P74,

Answers: 1) A; 2) A; 3) A

PROBLEM NO. 7

In connection with your examination of the financial statements of Nagbukel, Inc. for the year ended December 31, 2006, you were able to obtain certain information during your audit of the accounts receivable and related accounts.

The December 31, 2006 balance in the Accounts Receivable control accounts is P788,000. The

only entries in the Doubtful Accounts Expense account were:

A credit for P1,296 on December 2, 2006 because Company A remitted in full for the

accounts charged off on October 31, 2006; and

A debit on December 31 for the amount of the credit to the Allowance for Doubtful Accounts.

The Allowance for Doubtful Accounts schedule is follows:

Cebu CPAR Center, Inc. Cebu-CPAR

8

Debit Credit Balance January 1, 2006 P14, October 31, 2006 Uncollectible accounts: Company A – P1, Company B – P3, Company C – P2,256 P6,032 8, December 31, 2006 P39,400 P48,

An aging schedule of the accounts receivable as of December 31, 2006 is presented below:

Age

Net debit

balance

Amount to which the Allowance is to be adjusted after adjustments and corrections have been made 0 to 1 month P372,960 1 percent 1 to 3 months 307,280 2 percent 3 to 6 months 88,720 3 percent Over 6 months 24,000 Definitely uncollectible, P4,000; P8,000 is considered 50% uncollectible; the remainder is estimated to be 80% collectible.

There is a credit balance in one account receivable (0 to 1 month) of P8,000; it represents an advance on a sales contract. Also, there is a credit balance in one of the 1 to 3 months account receivable of P2,000 for which merchandise will be accepted by the customer.

The ledger accounts have not been closed as of December 31, 2006. The Accounts Receivable control account is not in agreement with the subsidiary ledger. The difference cannot be located, and you decided to adjust the control account to the sum of the subsidiaries after corrections are made.

QUESTIONS:

Based on the above and the result of your audit, answer the following:

1. How much is the adjusted balance of Accounts Receivable as of December 31, 2006? a.

P794,000 c. P798, b. P793,200 d. P802,

2. How much is the adjusted balance of the Allowance for Doubtful Accounts as of December 31, 2006?

a. P63,552 c. P18, b. P23,057 d. P19,

3. How much is the net adjustment to the Allowance for Doubtful Accounts?

a. P24,493 debit c. P28,943 debit

b. P15,552 credit d. P29,063 debit

4. How much is the Doubtful Accounts expense for the year 2006?

a. P13,961 b. P18,411 c. P58,456 d. P13,

5. How much is the net adjustment to the Doubtful Accounts expense account?

a. P20,352 debit c. P24,143 credit

b. P24,263 credit d. P19,693 credit

Suggested Solution:

Question No. 1

GL SL 0 to 1 1 to 3 3 to 6 Over 6 Unadjusted balances 788,000 792,960 372,960 307,280 88,720 24, Add (deduct): Understatement of accounts written off

(P6,832-P6,032) (800)

Definitely uncollectible accounts (4,000) (4,000) (4,000) Advances from customers 8,000 8,000 8, Accounts w/ credit balances 2,000 2,000 2,

Unlocated difference 5,

Adjusted balances 798,960 798,960 380,960 309,280 88,720 20,

Year of Sale 2002 2003 2004 2005 2006 2004 9, 2005 12, 2006 14,

Accounts receivable at December 31, 2006 were as follows:

From 2005 sales P 360,

From 2006 sales 3,240,

Total P3,600,

QUESTIONS:

Based on the above and the result of your audit, you are to provide the answers to the following:

1. The average percentage of net doubtful accounts to charge sales that should be used in setting up

the 2006 allowance is a. 2% c. 2% b. 1% d. 1%

2. How much is the doubtful accounts expense for 2006? a.

P131,400 c. P165, b. P218,400 d. P175,

3. The doubtful accounts expense for 2006 is over(under) stated by

a. P223,800 c. (P131,400) b. P 53,400 d. (P165,000)

4. The net realizable value of accounts receivable as of December 31, 2006 balance sheet is a.

P3,415,200 c. P3,326, b. P3,474,600 d. P3,240,

5. The adjusting journal entry necessary to set up the allowance for doubtful accounts as of December

31, 2006 will include a debit to Retained Earnings of a. P223,800 c. P165, b. P184,800 d. P 0

Suggested Solution:

Question No. 1

Year Charge sales AR written-off Recoveries

Net AR written-off 2002 P 2,400,000 P 61,200 P 2,400 P 58, 2003 6,000,000 148,800 9,600 139,

2004 7,200,000 204,000 12,000 192,

P15,600,000 P414,000 P24,000 P390,

Net AR written off P 390, Divide by charge sales P15,600,

Percentage 2%

Question No. 2

Doubtful accounts expense for 2006 (P6,600,000 x P2%) P165,

Question No. 3

Recorded doubtful accounts expense (P64,800 + P120,000 + P33,600) P214,

Should be doubtful accounts expense for 2006 165,

Overstatement of doubtful accounts expense P 53,

Question No. 4

Accounts receivable, 12/31/06 P3,600, Required allowance for doubtful accounts (see computation below) 184, Net realizable value, 12/31/06 P3,415,

(A) (B) (C) (D)

(A) x 2% AR (B)-(C)+(D)

Year Charge sales D/A expense written-off Recoveries Allowance 2005 P 7,800,000 P195,000 P156,000 P14,400 P 53,

2006 6,600,000 165,000 33,600 - 131,

P14,400,000 P360,000 P189,600 P14,400 P184,

Cebu CPAR Center, Inc. Cebu-CPAR

11

Question No. 5

Adjusting journal entry necessary to set up the allowance for doubtful accounts as of December 31, 2006: Bad debt recovery P 14, Retained earnings (see below) 223, Doubtful account expense P53, Allowance for doubtful accounts 184,

2002 2003 2004 2005 Total D/A exp provided P 13,200 P 60,000 P139,200 P172,800 P 385,

Less recoveries - 2,400 9,600 12,000 24,

Net 13,200 57,600 129,600 160,800 361, Should be D/A exp (Sales x

2%) 60,000 150,000 180,000 195,000 585,

Over (Under) (P46,800) (P92,400) (P50,400) (P34,200) (P223,800)

Answers: 1) A; 2) C; 3) B; 4) A, 5) A

PROBLEM NO. 9

Unless otherwise identified, the notes receivable of the Quirino Company on December 31, 2006, were trade notes receivable. On this date the balance of the account, P3,036,915, consisted of the following notes all received during the calendar year under audit:

Maker Date Term Rate Amount Remarks A Co. Oct. 1 6 mos. 18% P 57,416 Four notes to settle Oct. 1 12 mos. 18% 100,000 past due account. Oct. 1 18 mos. 18% 100,000 Current billings are Oct. 1 24 mos. 18% 100,000 on a 10 – day credit basis. B Co. July 1 36 mos. 18% 500,000 This note is for a cash loan made to this customer. No interest has been collected to date. C Co. Oct. 1 4 mos. 15% 251,636 All interest collected on Oct. 1. Mr. Pogi Feb. 1 Demand 18% 1,000,000 Loan approved in (Company minutes book, Jan. President) 20. On Aug. 1 this note was pledged as collateral for a bank loan P500,000. D Co. Nov. 1 12 mos. 15% 546,387 Interest payable at maturity E, Inc. Dec. 90 days 18% Interest payable at

10 381,476 maturity

P3,036,

All of the above notes are considered good except that of A Company which is somewhat doubtful. An allowance of 25% should be established against the notes receivable of this company.

QUESTIONS:

Based on the above and the result of your audit, compute the following:

1. Adjusted balance of Trade Notes Receivable as of December 31, 2006

a. P1,179,499 c. P2,036, b. P 927,863 d. P1,536,

2. Net realizable value of Trade Notes Receivable as of December 31, 2006

a. P1,447,561 c. P1,090, b. P1,947,561 d. P 838,

3. Interest income for the year ended December 31, 200 6

a. P243,749 c. P208, b. P253,185 d. P 43,

4. Accrued interest income as of December 31, 2006 a.

P253,185 c. P243, b. P 78,749 d. P198,

Suggested Solution:

Question No. 1

AA Company P 200, BB Company 900,

DD Company 120,

Adjusted balance of Notes Receivable P1,220, Notes:

1) AA Company will still be included in the balance of “Notes Receivable” since “Notes Receivable-Discounted”

account will be credited upon discounting. If the question is Notes Receivable that will be reported in the balance sheet, the Notes Receivable – Discounted will be excluded from the total Notes Receivable with disclosure of contingent liability.

2) E. Dy note was excluded since that will be reclassified to Subscriptions Receivable.

3) CC Company note was excluded because the note was dishonored. It will be reclassified to Accounts

Receivable, including the accrued interest.

4) Apol Bobads note was excluded due to the fact that it will be reclassified to Advances to Officers.

5) The fact that DD Company note is held by bank as collateral should be disclosed but the note will still be

included in the Notes Receivable.

Question No. 2

Notes receivable – trade (excluding note discounted amounting to P200,000) P1,020, Subscriptions receivable 500,

Advances to officers 160,

Amount that will be reported in the current assets section of the balance sheet P1,680,

Questions No. 3 & 4

Maker Date Amount Rate

Interest Income AIR E. Dy Nov. 1 P500,000 16% P 13,333 P 13, CC Com. May 3 600,000 16% 16,000 -

DD Co. Sep. 14 120,000 16% 5,760 5,

####### ) P35,093 P19,

Answers: 1) B; 2) C; 3) D; 4) A

PROBLEM NO. 11

The balance sheet of Santiago Corporation reported the following long-term receivables as of December 31, 2005:

Note receivable from sale of plant P9,000, Note receivable from officer 2,400,

In connection with your audit, you were able to gather the following transactions during 2006 and other information pertaining to the company’s long-term receivables:

a. The note receivable from sale of plant bears interest at 12% per annum. The note is payable in 3 annual

installments of P3,000,000 plus interest on the unpaid balance every April 1. The initial principal and interest payment was made on April 1, 2006.

b. The note receivable from officer is dated December 31, 2005, earns interest at 10% per annum, and is due on

December 31, 2008. The 2006 interest was received on December 31, 2006.

c. The corporation sold a piece of equipment to Yes, Inc. on April 1, 2006, in exchange for an P1,200,000 non-

interest bearing note due on April 1, 2008. The note had no ready market, and there was no established exchange price for the equipment. The prevailing interest rate for a note of this type at April 1, 2006, was 12%. The present value factor of 1 for two periods at 12% is 0 while the present value factor of ordinary annuity of 1 for two periods at 12% is 1.

d. A tract of land was sold by the corporation to No Co. on July 1, 2006, for P6,000,000 under an installment sale

contract. No Co. signed a 4-year 11% note for P4,200,000 on July 1, 2006, in addition to the down payment of P1,800,000. The equal annual payments of principal and interest on the note will be P1,353,750 payable on July 1, 2007, 2008, 2009,and 2010. The land had an established cash price of P6,000,000, and its cost to the corporation was P4,500,000. The collection of the installments on this note is reasonably assured.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Noncurrent notes receivable as of December 31, 2006 a.

P13,556,400 c. P10,556, b. P 9,664,650 d. P 9,750,

2. Current portion of long-term notes receivable as of December 31, 2006

a. P3,891,750 c. P3,000, b. P4,353,750 d. P 0

3. Accrued interest receivable as of December 31, 2006 a.

P771,000 c. P 540, b. P857,076 d. P1,011,

4. Interest income for the year 2006

a. P1,281,000 c. P1,367, b. P1,637,076 d. P1,512,

Suggested Solution:

Question No. 1

NR from sale of plant Balance, 12/31/ (P9,000,000 - P3,000,000) P6,000, Less inst. due on 4/1/07 3,000,000 P3,000, NR from officer, due 12/31/08 2,400, NR from sale of equipment Present value of note, 4/1/ (P1,200,000 x 0) 956, Add interest earned for 2006

(P956,400 x 12% x 9/12) 86,076 1,042,

NR from sale of land Balance, 12/31/06 4,200, Less principal installment due on 7/1/ Total amount to be received P1,353, Less interest

(P4,200,000 x 11%) 462,000 891,750 3,308,

Total P9,750,

Question No. 2

Note receivable from sale of plant due, 4/1/07 P3,000,

Note receivable from sale of land (see no. 1) 891,

Current portion of long-term notes receivable P3,891,

Question No. 3

NR from sale of plant (P6,000,000 x 12% x 9/12) P540,

NR from sale of land (P4,200,000 x 11% x 6/12) 231,

Accrued interest receivable, 12/31/06 P771,

Question No. 4

NR from sale of plant: 1/1 to 3/31 - P9,000,000 x 12% x 3/12 P 270,

4/1 to 12/31 - P6,000,000 x 12% x 9/12 540,

810, NR from officer (P2,400,000 x 10%) 240, NR from sale of equipment (P956,400 x 12% x 9/12) 86,

NR from sale of land (P4,200,000 x 11% x 6/12) 231,

Interest income for 2006 P1,367,

Answers: 1) D; 2) A; 3) A; 4) C

PROBLEM NO. 12

Sigay Company has been using the cash method to account for income since its first year of operation in 2005. All sales are made on credit with notes receivable given by the customers. The income statements for 2005 and 2006 included the following amounts:

2005 2006 Revenues – collection on principal P1,600,000 P2,500, Revenues – interest 180,000 275, Cost of goods purchased* 2,260,000 2,601,

Question No. 5 Principal amount collected in 2006 on 2006 note P1,279,

Multiply by gross profit rate in 2006 43%

Realized gross profit in 2006 on 2006 inst. sales P 553,

Computation of gross profit rate in 2006: Installment sales for 2006 P3,877,

Less cost of installment sales (P2,601,000 - P400,000) 2,201,

Gross profit for 2006 1,676,

Divide by installment sales for 2006 3,877,

Gross profit rate in 2006 43%

Answers: 1) B; 2) A; 3) C; 4) D, 5) D

PROBLEM NO. 13

On January 1, 2004, Sinait Company loaned P3,000,000 to Ilocos Company. The terms of the loan were payment in full on January 1, 2009, plus annual interest payments at 11%. The interest payment was made as scheduled on January 1, 2005; however, due to financial setbacks, Ilocos was unable to make its 2006 interest payment. Sinait considers the loan impaired and projects the following cash flows from the loan as of December 31, 2006 and 2007. Assume that Sinait accrued the interest at December 31, 2005, but did not continue to accrue interest due to the impairment of the loan.

Amount projected as of Date of Flow Dec. 31, 2006 Dec. 31, 2007 December 31, 2007 P 200,000 P 200, December 31, 2008 400,000 600, December 31, 2009 800,000 1,200, December 31, 2010 1,200,000 1,000, December 31, 2011 400,

QUESTIONS:

Your client requested you to determine the following: (Round-off present value factors to four decimal places)

1. Loan impairment (bad debt expense) for the year 2006 a.

P 882,380 c. P1,212, b. P1,549,500 d. P1,542,

2. Interest income for 2007 assuming the P200,000 was collected on December 31, 2007 as scheduled

a. P195,855 c. P200, b. P232,938 d. P 66,

3. Allowance for loan impairment as of December 31, 20 07

a. P554,340 c. P649, b. P752,640 d. P776,

4. Interest income for 2008 assuming the P600,000 was collected on December 31, 2008 as scheduled

a. P225,210 c. P236, b. P247,023 d. P222,

5. Carrying amount of loan receivable as of December 31, 2008

a. P1,672,570 c. P1,645, b. P2,150,558 d. P1,892,

Suggested Solution:

Question No. 1

Principal P3,000,

Add accrued interest in 2005 (P3,000,000 x 11%) 330,

Carrying amount, 12/31/06 3,330,

Less PV of projected cash flows (see below) 2,117,

Loan impairment (bad debt expense) P1,212,

Date Collection Period PVF at 11% Present value Dec. 31, 2007 P 200,000 1 year 0 P 180, Dec. 31, 2008 400,000 2 years 0 324, Dec. 31, 2009 800,000 3 years 0 584, Dec. 31, 2010 1,200,000 4 years 0 790,

Dec. 31, 2011 400,000 5 years 0 237,

P3,000,000 P2,117,

Journal entry to record the loan impairment: Bad debt expense P1,212, Interest receivable P 330, Allowance for loan impairment 882,

Note: PAS 39 par. 63 states that the carrying amount of the asset shall be reduced either directly or through the use of an allowance account. The use of allowance account is preferable since this will inform the users of the gross amount of the impaired loan receivable.

Question No. 2

Interest income for 2007 (P2,117,620 x 11%) P232,

Incidentally, the following are the journal entries to record the collection: Cash Loan receivable

P200, P200,

Allowance for loan impairment Interest income

P232, P232,

Question No. 3

Principal, 12/31/07 (P3,000,000 - P200,000) P2,800,

Less PV of projected cash flows (see below) 2,245,

Allowance for loan impairment, 12/31/07 P 554,

Date Collection Period PVF at 11% Present value Dec. 31, 2008 P 600,000 1 year 0 P 540, Dec. 31, 2009 1,200,000 2 years 0 973,

Dec. 31, 2010 1,000,000 3 years 0 731,

P2,800,000 P2,245,

Journal entry to adjust net loan receivable to present value of new cash flow projections. Allowance for loan impairment (P882,380 - P232,938 - P554,340) P95, Bad debt expense P95,

Question No. 4

Interest income for 2008 (P2,245,660 x 11%) P247,

Question No. 5

Principal, 12/31/08 (P2,800,000 - P600,000) P2,200, Less allowance for loan impairment, 12/31/

(P554,340 - P247,023) 307,

Carrying value, 12/31/08 P1,892,

Answers: 1) C; 2) B; 3) A; 4) B, 5) D

PROBLEM NO. 14

Tagudin Co. required additional cash for its operation and used accounts receivable to raise such needed cash, as follows:

On December 1, 2006 Tagudin Company assigned on a nonnotification basis accounts receivable of

P5,000,000 to a bank in consideration for a loan of 90% of the receivables less a 5% service fee on the accounts assigned. Tagudin signed a note for the bank loan. On December 31, 2006, Tagudin collected assigned accounts of P3,000,000 less discount of P200,000. Tagudin remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance.

Tagudin Co. sold P1,550,000 of accounts receivable for P1,340,000. The receivables had a carrying

amount of P1,470,000 and were sold outright on a nonrecourse basis.

Tagudin Co. received an advance of P300,000 from Union Bank by pledging P360,000 of accounts

receivable.

On June 30, 2006, Tagudin Co. discounted at a bank a customer’s P600,000, 6-month, 10% note

receivable dated April 30, 2006. The bank discounted the note at 12% on the same date.

PROBLEM NO. 15

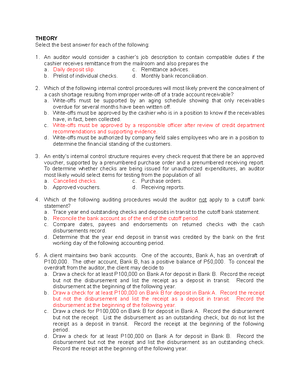

Select the best answer for each of the following:

1. An auditor is testing sales transactions. One step is to trace a sample of debit entries from the

accounts receivable subsidiary ledger back to the supporting sales invoices. What would the auditor intend to establish by this step?

a. Sales invoices represent bona fide sales.

b. Debit entries in the accounts receivable subsidiary ledger are properly supported by sales invoices.

c. All sales invoices have been recorded.

d. All sales invoices have been properly posted to customer accounts.

2. Tracing bills of lading to sales invoices provides evidence that

a. Shipments to customers were recorded as sales.

b. Shipments to customers were invoiced.

c. Recorded sales were shipped.

d. Invoiced sales were shipped.

3. Proper authorization procedures in the revenue/receipt cycle usually provide for approval of write-offs

by an employee in which of the following departments?

a. Accounts receivable c. Billing

b. Treasurer d. Sales

4. To gather audit evidence about the proper credit approval of sales, the auditor would select a sample

of documents from the population represented by the

a. Subsidiary customers' accounts ledger.

b. Sales invoice file.

c. Customer order file.

d. Bill of lading file.

5. In determining validity of accounts receivable, which of the following would the auditor consider most

reliable?

a. Direct telephone communication between auditor and debtor.

b. Documentary evidence that supports the accounts receivable balance.

c. Confirmation replies received directly from customers.

d. Credits to accounts receivable from the cash receipts book after the close of business at year end.

6. When the objective of the auditor is to evaluate the appropriateness of adjustments to sales, the best

available evidence would normally be

a. Documentary evidence obtained by inspecting documents supporting entries to adjustment

accounts.

b. Oral evidence obtained by discussing adjustment-related procedures with controller personnel.

c. Analytical evidence obtained by comparing sales adjustments to gross sales for a period of time.

d. Physical evidence obtained by inspection of goods returned for credit.

7. Which source document should an auditor use to verify the correct sales date for an item sold FOB

shipping point?

a. Sales invoice. c. Customer's payment document.

b. Carrier's bill of lading. d. Customer's purchase order.

8. Which of the following procedures would an auditor most likely rely on to verify management's

assertion of completeness?

a. Confirm a sample of recorded receivables by direct communication with the debtors.

b. Observe the client's distribution of payroll checks.

c. Compare a sample of shipping documents to related sales invoices.

d. Review standard bank confirmations for indications of kiting.

9. The negative form of accounts receivable confirmation request is particularly useful except when

a. Individual account balances are relatively large.

b. Internal control surrounding accounts receivable is considered to be effective.

c. A large number of small balances are involved.

d. The auditor has reason to believe the persons receiving the request are likely to give them

consideration.

10. An auditor who wishes to substantiate the gross balance of the account "Trade Notes Receivable" is

considering the advisability of performing the four procedures listed below. Which pair of procedures is best suited to this objective?

I. Age the receivables.

II. Confirm the notes with the makers.

III. Inspect the notes.

IV. Trace a sample of postings from the sales journal to the notes receivable ledger.

a. I and III. b. II and III c. I and IV. d. I and IV

Quiz 2020, questions and answers

Course: BS in Accountancy

University: Saint Mary's University Philippines

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades