- Information

- AI Chat

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Was this document helpful?

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Effective Interest Method

Course: Accounting

999+ Documents

Students shared 2591 documents in this course

University: University of Manila

Was this document helpful?

This is a preview

Do you want full access? Go Premium and unlock all 9 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

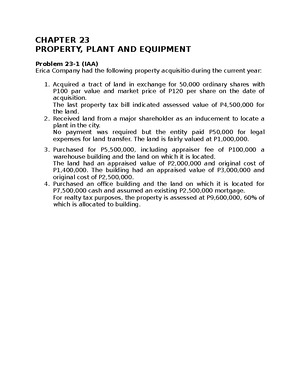

EFFECTIVE INTEREST METHOD

Market price of bonds

PFRS 9 requires that discount on bonds payable, premium on bonds payable and bond issue cost

shall be amortized using the effective interest method.

This method distinguishes two kinds of interest rates, namely:

1. Nominal rate is the coupon or stated rate

2. Effective rate is yield or market rate

The effective rate is the rate that exactly discounts estimated cash future payments through the

expected life of the bonds payable or when appropriate, a shorter period to the net carrying

amount of the bonds payable.

•When bonds are sold at a premium, the effective rate is lower than the nominal rate.

•When bonds are sold at a discount, the effective rate is higher than the nominal rate.

Effective interest method

Under the effective interest method, the effective interest expense is determined by multiplying

the effective rate by the carrying amount of the bonds.

The carrying amount of the bonds changes every year as the amount of premium or discount is

amortized periodically.

Discount amortization = Effective interest - Nominal interest

Interest paid = Face amount x nominal rate

Interest expense = Carrying amount x effective rate

Discount amortization = Interest expense – interest paid

Carrying amount = preceding carrying amount + discount amortization

Illustration: Effective amortization of discount 1,000,000 x 8% x 6/12= 40,000

On January 1, 2020, an entity issued two-year 8% bonds with face amount of P1,000,000 for

P964,540, a price which will yield a 10% effective interest cost per year. Interest is payable

semiannually on June 30 and December 31.

Interest Interest Discount Carrying

Date paid expense amortization amount

Jan.1, 2020 964,540

June 30, 2020 40,000 48,227 8,227 972,767

Dec. 31, 2020 40,000 48,638 8,638 981,405

June 30, 2021 40,000 49,070 9,070 990,475

Dec. 31, 2021 40,000 49,525 9,525 1,000,000

Journal entries for 2020:

1/1/20 – Issuance of bonds

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.