- Information

- AI Chat

Chapter 1-2 COST Accounting AND Control BY DE LEON 2019

Cost Accounting and Control (ACC 3107)

Related documents

- Rizal OUR Nnational HERO

- SHIP Stability Board Question

- Araling Panlipunan 8 Quarter 1 Module 1 Katangiang Pisikal ng Daigdig V2

- Lecture Notes - AFP Customs AND Tradition

- Essay - THE Condition OF Science AND Technology During THE American AND Spanish Period

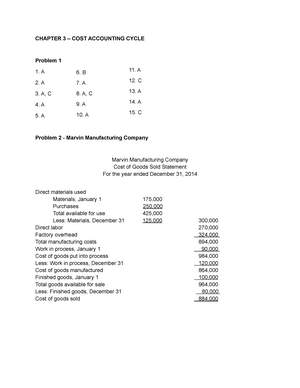

- Chapter 3 COST Accounting AND Control BY DE LEON 2019

Preview text

Chapter 1

TRUE/FALSE

1. TRUE 6. FALSE

2. TRUE 7. TRUE

3. FALSE 8. FALSE

4. TRUE 9. TRUE

5. TRUE 10

MULTIPLE CHOICE

1. B 6. D 11. D

2. C 7. A 12. B

3. A 8. A 13. B

4. C 9. B 14. A

5. C 10 15. D

Chapter 2 - Costs – Concepts and classification

Problem 1- Ram Corporation

- Manufacturing overhead 6. Manufacturing overhead

- Manufacturing overhead 7. Direct materials

- Direct materials 8. Manufacturing overhead

- Direct labor 9. Manufacturing overhead

- Manufacturing overhead 10. Manufacturing overhead

Problem 2

- Manufacturing 6. Manufacturing

- Selling 7. Administrative

- Manufacturing 8. Selling

- Selling 9. Administrative

- Administrative 10

Problem 3-Rocco Product Cost Period Cost Direct mat. Direct labor Mfg. OH Selling Adm. 1. DM 220, 2. Factory rent 50, 3. Direct labor 180, 4. Factory utilities 8, 5. Supervision 60, 6. Depreciation-FE 20, 7. Sales Commission 57, 8. Advertising 47, 9. Depreciation-OE 10, 10 - pres. 250,

- TOTAL PRODUCT COST = 220,000 + 180,000 + 138,

- TOTAL PERIOD COST = 57,000 + 307,

- COST PER UNIT = 538,500/ 40,000 units = P 13,

Problem 6 – Marvin Desk

- DM 8. OH

- OH 9. OH

- OH 10. DL

- OH 11. OH

- DL 12. OH

- OH 13, OH

- OH 14. OH 15. DM

Problem 7 – Mother Goose Company

- Prime costs - 530,

- Conversion cost - 575, 3 Inventoriable cost - 860,

- Total period costs - 305,

Problem 8 –

a. c - fixed (total amount is constant)

b. a – variable (4,480/3,200 = 1; 6,300/4,500 = 1 per unit is constant) c. d - mixed ( 3,950/3,200 = 12; 5,250/4,500 = 1) total amount and amount per unit varies in relation to units sold)

Problem 9 - Blanche Corporation

- Direct materials used P 32.

- Direct labor 20.

- Variable manufacturing overhead 15.

- Variable marketing 3.

- Total variable cost per unit 70.

- X No. of units produced and sold 12,

- Total variable costs per month P 840,

- Fixed manufacturing overhead P 6.

- Fixed marketing costs 4.

- Total fixed cost per unit 10.

- X No. of units produced and sold 12,

- Total fixed costs per month P 120,

- Problem

- Direct materials P 60.

- Direct labor 30.

- Variable manufacturing overhead 9.

- Total variable manufacturing cost per unit P 99.

- Total variable manufacturing cost per unit P 99.

- Variable marketing and administrative 6.

- Total variable costs per unit 105.

Problem 12 – Valdez Motors Co.

Variable cost per machine hour = 5,475 – 3, 210 - 145 = 23 per machine hour

210 hours 145 hours Total overhead costs 5,475 3, Less: Variable costs ( 210 x 23) 4, ( 145 x 23) 3, Fixed cost 628 628

Problem 13 – Marco Company Department A Department B

Direct materials P 400,000 P 700, Direct labor 350,000 600, Factory supplies 10,000 24, Direct variable costs P 760,000 P 1,324,

Controllable direct fixed costs Supervisory salaries P 45,000 P 55,

Uncontrollable direct fixed costs: Depreciation – machinery and Equipment P 100,000 P 180,

Controllable direct fixed cost P 45,000 P 55, Uncontrollable direct fixed cost 100,000 180, Total direct fixed cost P 145,000 P 235,

Allocated costs from headquarters P 120,000 P 180, Allocated repairs & maintenance 40,000 80, Allocated factory rent – bldg. 60,000 140, Allocated plant executive’s salaries 140,000 210, Total indirect costs P 360,000 P 610,

Allocated costs from headquarters P 120,000 P 180, Allocated factory rent – bldg. 60,000 140, Allocated plant executive’s salaries 140,000 210, Depreciation- mach. & equipment 100,000 180, Total unavoidable costs P 420,000 P 710,

True/False Questions

- False 6. True 11. False 16. True

- False 7. False 12. False 17. False

- True 8. True 13. True 18. True

- False 9. False 14. False 19. False

- False 10. True 15. False 20. True

Chapter 1-2 COST Accounting AND Control BY DE LEON 2019

Course: Cost Accounting and Control (ACC 3107)

University: University of Perpetual Help System DALTA

- Discover more from:

Students also viewed

Related documents

- Rizal OUR Nnational HERO

- SHIP Stability Board Question

- Araling Panlipunan 8 Quarter 1 Module 1 Katangiang Pisikal ng Daigdig V2

- Lecture Notes - AFP Customs AND Tradition

- Essay - THE Condition OF Science AND Technology During THE American AND Spanish Period

- Chapter 3 COST Accounting AND Control BY DE LEON 2019