- Information

- AI Chat

Sample/practice exam 2015, questions and answers

Auditing and Assurance Services (200535)

Western Sydney University

Recommended for you

Preview text

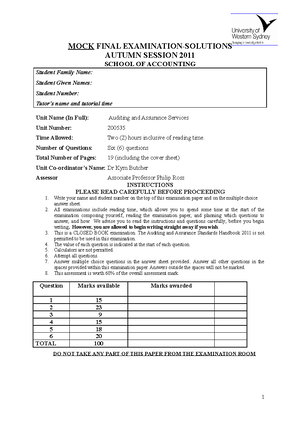

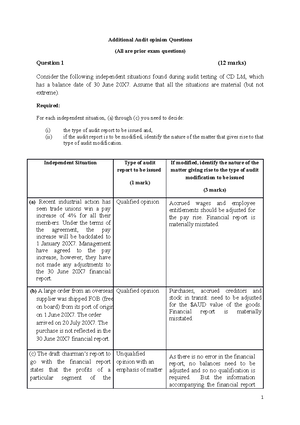

MOCK FINAL EXAMINATION AUTUMN SESSION 2015 SCHOOL OF BUSINESS Student Family Name: Student Given Names: Student Number: Course: Unit Name (In Full): Auditing and Assurance Services Unit Number: 200535 Time Allowed: 2 hours, including reading time Number of Questions: Six Total Number of Pages: 11 pages, including exam cover sheet Name: Stella Wu 1. 2. 3. 4. 5. 6. INSTRUCTIONS PLEASE READ CAREFULLY BEFORE PROCEEDING Write your name and student number on the top of this examination paper. All examinations include reading time. We advise you to read the instructions and questions carefully, before you begin writing. However, you are allowed to begin writing straight away if you wish. This is a CLOSED book examination. Calculators are not permitted. Answer all questions in the spaces provided within this examination paper, including multiple choice questions. The value of all questions is shown below. VALUE QUESTION ONE QUESTION TWO QUESTION THREE QUESTION FOUR QUESTION FIVE QUESTION SIX TOTAL SCORE 18 24 15 15 16 12 100 DO NOT TAKE THIS PAPER FROM THE EXAMINATION ROOM Disclaimer: The purpose of this mock exam paper is to assist students in their preparation for the final examination. Students should be aware that final examination paper may be different 1 to this paper in both format and questions. Therefore, it is important for students to revise all relevant learning materials, including textbook, lecture notes and tutorial questions. QUESTION ONE (18 MARKS) Jimmy Jones is an auditor on the CXZ Limited audit engagement for the year ended 30 June 2012. Jimmy has performed a number of tests in relation to accounts payable. The results are summarized in the following table. Required: WK12 Summary 1. Explain the difference between substantive test and test of control. (4 marks) Test of controls: an audit procedure designed to evaluate the operating effectiveness of controls in preventing, or detecting and correcting material misstatements at the assertion level. Substantive tests: tests performed to obtain audit evidence to detect material misstatements at the assertion level. These involve substantive tests of details (transactions and balances) and substantive analytical procedures. 2. For each of the test results: chapter 104 a. Identify whether this is a test of control or substantive test of detail. 2 QUESTION TWO (24MARKS) chapter inherent risks and internal control risks Consider the following independent situations, all of which apply to audits of entities for the year ending 30 June 2010. Required: For each of the three situations described below complete the following: (i) (ii) (iv) Identify the impact on the component (s) of audit risk affected and explain why it is an audit risk Identify key account balance affected Identify the prime audit assertion of interest to the auditor Identify one substantive test of detail audit procedure you would use to test the assertion identified. NB: The situations are independent of each other and are to be treated separately in your answers. For each component only your first answer (s) will receive marks. Writing multiple answers may result in nil marks being awarded. Description of audit risk (1) Bill Simith was the CEO and director of Peak Ltd, until he died unexpectedly. After his death, his son, Will Simith, became the new CEO and embarked on a exercise, which included a reduction in key staff in the credit department. Impact on the component of audit risk affected (1 mark) and explanation as to why it is an audit risk (1 mark) Increase control risk Reduced staff would mean reduced segregation of duties. Internal control in the credit department may be affected. Key Account Balance Affected (ONE account only) (2 marks) Accounts receivable Prime Assertion (ONE assertion only) (2 marks) Valuation and allocation Substantive test of detail audit procedure to reduce risk (ONE procedure only) (2 marks) Review aged trial balance and undertake procedures for amounts overdue, such as review of subsequent receipts. 4 Description of audit risk (a) (2) You are a audit senior for the audit of Prestige Ltd (Prestige). In early 2007, Prestige acquired a small manufacturer of organic hair styling products, Glitzy Pty Ltd (Glitzy). Prestige Management had identified that line of products would fit extremely well with the Prestige business, and organised funding from current bank, Money Wise. As part of the audit, the Link and Associates audit team discovered that Glitzy uses special formulas to create its products. Only the owner of Glitzy knows the secret ingredients for the formulas. These secret ingredients are apparently documented and held with solicitors. The audit team has noted that no asset has been recognised on the statement of financial position of Glitzy in relation to this intellectual property (IP). management has been advised that this IP has the potential to be both a material and valuable asset. Impact on the component of audit risk affected (1 mark) and explanation as to why it is an audit risk (1 mark) inherent risk of misstatement. and obligations formulas were kept with solicitors but seem to have been developed the owner of Glitzy. What evidence is there that ownership of the IP has been transferred to Glitzy and then transferred to Prestige? and allocation given that the continued manufacture of the Glitzy hair products depends on the special ingredient formulations, the IP is likely to be of high value to the business. Has the correct value been brought to account? Key Account Prime Assertion Balance Affected (ONE assertion (ONE account only) only) (2 marks) (2 marks) Intellectual Property Rights and (Intangible asset) and Valuation and allocation Substantive test of detail audit procedure to reduce risk (ONE procedure only) (2 marks) Practical substantive procedures could include: and obligations sight a copy of the of the IP from the owner (not Glitzy since there is no evidence that the owner ever transferred to Glitzy) to Prestige. Check that the necessary protection documents have been put in place e. preventing owner from or using. and consider engaging an IP specialist to properly value the intangible asset. 5 QUESTION THREE (15 MARKS) 12 You are the auditor for Grapevine Australia Ltd (Grapevine), a wine production and distribution company, for the year ended 30 June 2012. Your report was signed on 24 August 2012. The financial report was approved on the same day the directors of Grapevine. The financial report was issued to shareholders on 10 September 2012. The following material events occurred or became known to you from 30 June 2012 onwards. Assume that each event is material. Required: For each of the following independent and material situations, select the appropriate action from the list below, and justify your response: A . Adjust the 30 June 2012 financial report. B. Disclose the information in a note to the 30 June 2012 financial report. C. Request that the client recall the 30 June 2012 financial report for revision. D. No action is required. (1) On 21 July 2012, a massive dust storm ruined the entire wine grape harvest. The loss was only partly insured. (2) On 25 September 2012, management informed you that a lawsuit that commenced on 1 August 2011 and which was noted as a contingency in the 30 June 2012 financial report was ruled court on 15 August 2012. The damages are four times higher than estimated on 30 June 2012. (3) On 25 September 2012, management informed you that a lawsuit that commenced on 1 August 2011 and which was noted as a contingency in the 30 June 2012 financial report was ruled court on 27 August 2012. The damages are four times higher than estimated on 30 June 2012. Required: For each of the above events or transactions, indicate the treatment required in the financial report and give reasons for your decision. Treatment required in the financial report (2 marks each) (1) B (2) C (3) D Explanation(3marks each) The dust storm is a event. It does not provide evidence of conditions existing at the balance date. The loss was only partly insured, this event will have a significant effect on the coming year. Therefore, the event should be disclosed in the notes to the financial report. Auditor become aware of the court decision after the financial was issued. The legal case was ruled on 15 August 2012, which is before the date of auditor report. If the court decision had been known to the auditor at the date of the report, it may have caused the auditor to amend the report. Therefore, auditor will request management to recall the financial report for revision. Auditor become aware of the court decision after the financial was issued. The legal case was ruled on 27 August 2012, which is after the date of auditor report. Auditor has no responsibilities for events occurred after the date of auditor report. Therefore, no action is required. 7 QUESTION FOUR (15MARKS) 13 unseen, 13 For each of the following independent and material circumstances, identify the type of audit opinion required and explain the basis of your answer. (1) A client holds a note receivable consisting of principal and accrued interest receivable. The maker recently filed a voluntary bankruptcy petition, but the client failed to reduce the recorded value of the note to its net realisable value, which is approximately 20 percent of the recorded amount. Audit opinion(2marks) qualified opinion Explanation(3marks) . A qualified opinion would be issued because of a disagreement with those charged with governance about the valuation of the note receivable. The amount involved is material but not therefore, a qualified rather than an adverse opinion would be issued. (2) A client changes its method of accounting for the cost of inventories from FIFO to weighted average. The auditor concurs with the change although it has a material effect on the financial report and has not been disclosed. Audit opinion(2marks) qualified opinion Explanation(3marks) A qualified opinion would be issued because of the disagreement with those charged with governance regarding the lack of disclosure of the change in accounting policy. The amount involved is material but not therefore, a qualified rather than an adverse opinion will be issued. (3) Due to losses and adverse key financial ratios, an auditor has substantial doubt about a ability to continue as a going concern for a reasonable period of time. The client has adequately disclosed its financial difficulties in a note to its financial report, which do not include any adjustments that might result from the outcome of this uncertainty. Audit opinion(2marks) unqualified opinion with an emphasis of matter Explanation(3marks) An unqualified opinion would be issued with an emphasis of matter paragraph drawing attention to the inherent uncertainty, which has been adequately disclosed. Adjustments to the financial report are only necessary when the going concern assumption is not appropriate. 8 QUESTION SIX (12MARKS) 4. additional question a) ABC Manufacturing Ltd (ABC) sought a million loan from Bank of Australia. The bank insisted that audited financial statements be submitted before it would extend the credit. ABC agreed to do this and also agreed to pay the audit fee. An audit was performed Pride Accountants which submitted audit report to ABC to be used solely for the purpose of the loan negotiation with the Bank of Australia. The Bank of Australia, after reviewing the audited financial statements, decided not to extend the loan to ABC. The Bank of Australia had been using some ratios from the financial statements and decided they were too low. ABC then presented the audited financial statements to another financial institution, Safebank, and obtained million loan from Safebank. Six months later ABC went into receivership and defaulted on its loan. Safebank discovered that inventory accounts have been significantly overstated and sued Pride Accountants for negligence. Pride Accountants strongly denied the claim and argued that they had relied on management representation letter for valuation of inventory. Required: Discuss the likelihood of Safebank winning a negligence claim against Pride Accountants. Solution In order to establish a cause of action for negligence against the auditors, Safebank must prove that: The auditors owed a legal duty of care to Safebank The auditors breached the legal duty failing to perform the audit with the due care and competence expected of members. Safebank suffered actual losses or damages. There is a causal relationship between the negligent conduct and the losses suffered Safebank In this case, the auditor has knowledge that the financial statements will be used for the purpose of loan negotiation with the Bank of Australia and likely owes a duty of care to the Bank of Austrlia. For the other financial institutions such as Safebank which subsequently lent money to ABC, it is difficult to argue that duty of care should be extended to them. The auditor was not in privity of contract with Safebank, and the financial statements were neither audited for the primary benefit of the Safebank. Esanda Finance Corp Ltd v. Peat Marwick Hungerfords (1994) endorsed the decision in the Caparo case that an auditor is not under a duty of care to the plaintiff unless the auditor intended to induce the plaintiff to act in reliance on the report. In this case, Pride Accountant could argue that they never intended to induce Safebank to rely on the audit report. Given the facts that initial plan was to seek a million loan from Bank of Australia, and it was the Bank of Australia that requested the audited final statements, it can be argued that the audit was 10 performed mainly for the benefit of Bank of Australia, rather than for any other financial institutions. In addition, it is also important to examine the terms of the engagement to ascertain whether the Bank of Australia was named as the only bank in the negotiations. If this is the case, it will provide additional evidence to support that the auditor does not owe a duty of care to any other financial institutions. Further, Pacific Acceptance (1970) established that auditors should exercise reasonable care and skill. In this case conduct is likely to be negligent as he failed to discover the overvaluation of inventory. Some may argue that the fact that the auditor did not discover the overvaluation of inventory does not necessary means that conduct is negligent if the auditor is able to argue that he had exercised reasonable care and skill and complied with regulatory requirements including professional and ethical standards (see Pacific Acceptance). However, the fact that auditor had relied on management representation letter for valuation of inventory suggests that auditor is likely to be found negligent. Pacific Acceptance (1970) confirmed the standards of reasonable care and skill, which includes that auditors have a duty to check and see for themselves. To rely on the personnel management is an aid, but not a substitute for procedures. Auditing standard also requires that when inventory is material, the auditor should obtain sufficient appropriate audit evidence regarding its existence and condition attending the physical unless it is impractical to do so. It is clear in this case that Safebank suffered losses as ABC had defaulted its loan. It is also likely that losses were a direct result of negligence because the negligently prepared financial reports formed the major basis for its decision making. However, the auditors will not be liable to Safebank for negligence because they owed no duty of care to it. Therefore, it is unlikely that Safebank will win the case against Pride Accountants. END OF EXAMINATION PAPER 11

Sample/practice exam 2015, questions and answers

Course: Auditing and Assurance Services (200535)

University: Western Sydney University

- Discover more from: