- Information

- AI Chat

ACC 201 Module Two Short Paper

Financial Accounting (ACC201)

Southern New Hampshire University

Recommended for you

Preview text

Running head: ACC 201 MODULE TWO SHORT PAPER 1

ACC 201 Module Two Short Paper: The Accounting Cycle Joseph A. Sapp Southern New Hampshire University

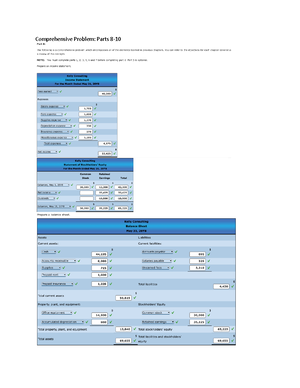

The focus of this paper is to outline the importance of the accounting cycle. The accounting cycle is a series of events that make up a process, from the identification and measurement of accounting events and recording them until the completion of the accounting process. The cycle begins when an accounting transaction takes place. It will end when the event is input in the financial statements of the company. Then the period starts again when other accounting events occur. The accounting cycle is significant because it gives businesses uniformity and consistency, check and balance, evaluation of company performance, the efficiency of business processes, and compliance with laws and federal regulations. There are ten steps within the accounting cycle to be used for the operations of a business. First, is Beginning Accounting Balances, which are events that are analyzed to figure

out the impact on the finances using the accounting equation by evidence that economic activity

has happened. Second, is Analyze & Journalize Transactions as They Occur. Transactions that have an impact on the company's finances are input in the general journal. Third, Post Journal Entries to the Accounts. These are transactions that are journalized and then posted to the accounts, or what people term as the "book of final entry." Fourth, Compute the Unadjusted

Balance & Prepare Unadjusted Trial Balance. Step four is assembling and analyzing adjustment

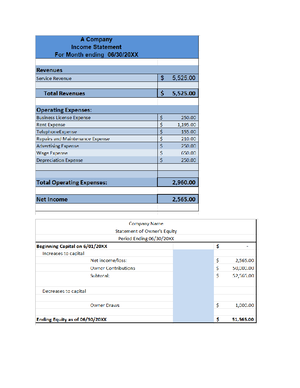

data. Before the preparation of financial statements, the updating of accounts must occur. Fifth, Add Unadjusted Trial Balance & Compliance Worksheet. If one is to adhere to the accrual basis of accounting, adjusting entries have to be input. Adjusting entries make sure that the revenue recognition and matching principles are correct. Sixth would be to Journalize & Post Adjusting Entries. This document is for internal use and is not a financial statement. It used to create the income statement and balance sheet with the proper information for preparing a cash flow statement. Seventh, Prepare the Adjusted Trial Balance. After correcting and adjusting entries, it

change in retained earnings to adjust for the payment of dividends. The Statement of Retained Earnings uses data from the Income Statement to calculate the net income from the income statement retained by a company, paid as dividends, or a combination of both. The accounting cycle makes sure that all accounts that debits and credits are equal and documented. It makes it possible for businesses to compare their results with other companies in their industry. One of the most important reasons is for legal purposes governed by federal, state, and private organizations. Steps one, three, and seven stand out amongst the ten for a reason stated previously. There is no beginning of the account balance if you don't start there. Beginning the account balances is the start of tracking finances. Step three is important because it shows the company's accounts and the changes that happened to those accounts through different transactions, along with the current balance on the account. Preparing the Financial Statements is the most important because it describes the company's income, equity, financial position, and cash flow, and can include notes that provide any specific details about the company's operations. To summarize, the accounting cycle is a process by which a company identifies, analyzes, and records its financial and accounting details. The reason for the accounting cycle is to create reports known as financial statements. A business uses the accounting cycle's financial statements to ensure balances are accurate, improve efficiency, and the overall performance of a company during the fiscal period.

Reference Warren, C., Reeve, J. M., & Duchac, J. (2017). Corporate financial accounting (14th ed.). Boston, MA: Cengage Learning. Kwok, Benny K. Accounting Irregularities in Financial Statements. Gower Publishing, Ltd., 2005. Hey-Cunningham, David. Financial Statements Demystified. Allen & Unwin, 2002. Taulli, Tom. The Edgar Online Guide to Decoding Financial Statements. J. Ross Publishing, 2004. Taylor, Peter. Book-Keeping & Accounting for Small Business. Business & Economics, 2003. Atrill, Peter. Accounting and Finance for Nonspecialists. Prentice-Hall, 1997. Chari, V. V.; Kehoe, Patrick J.; McGrattan, Ellen R. (2007). "Business Cycle Accounting." Econometrica. 75 (3): 781–836.

ACC 201 Module Two Short Paper

Course: Financial Accounting (ACC201)

University: Southern New Hampshire University