- Information

- AI Chat

Was this document helpful?

Econ 101 Exam 1 Cheat Sheet

Course: Principles of Economics I (Econ 101)

265 Documents

Students shared 265 documents in this course

University: University of Michigan

Was this document helpful?

Vocab:

1. Models: simplifications to understand complex situations and draw conclusions of cause

and effect

2. Ceteris Paribus assumption: all else equal

Concepts:

1. Circular Flow Model

a. Households, markets, firms, factor markets

b. 2 agents,2 markets

c. Does not account for saving → assumes that all money is spent

d. Does not account for the fact that people get paid a different amount for labor

2. Models

a. The point of models is to make positive statements about the world

b. Positive statements are objective facts (can be incorrect)

c. Developed in support of normative claims → what ought to be

d. Make positive statements to make normative statements

e. Models work by making logical statements based on assumptions

f. If then statements

3. Opportunity cost

a. The value of the next-best option

b. A measure of the value of the choice you made, rather than the value of what you

gave up

c. Economic cost

4. Economic costs

a. The total value of what’s given up to make some choice

5. Accounting costs

a. Explicit costs → money outlays required to make a choice

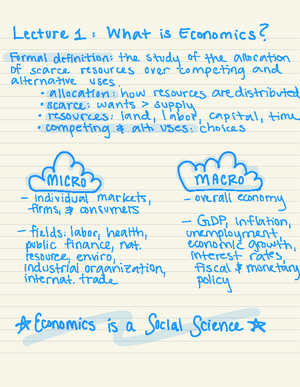

6. Economics

a. Study of choice where we have unlimited wants and scarce resources

(constrained choices)

7. Either-or decision

a. Sometimes called the extensive margin

b. Picking one option out of many

8. Either-or decision principle

a. Always make the choice that has positive economic profit

b. Every choice but the best has negative economic profit

9. How much decision

a. Sometimes called the intensive margin

b. Given either-or, how much do you do of that thing

10. Cost-benefit analysis

a. Rational person makes the choice that maximizes net benefits given: