- Information

- AI Chat

Was this document helpful?

EFE Matrix - easier for student to get lecture notes

Course: Business studies (BA111)

999+ Documents

Students shared 2187 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

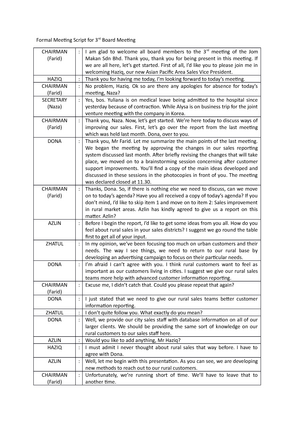

EFE MATRIX

KEY EXTERNAL FACTORS WEIGHT RATING WEIGH

T

SCORE

OPPORTUNITIES

1 Increase the number of young individuals,

which is the primary target.

0.08 4 0.32

2 New smartphone devices 0.09 4 0.36

3 Broadband population underserved 0.05 4 0.20

4 Produce backhaul capacity primarily for

wireless broadband

0.05 4 0.20

5 Possibilities for triple play if link with

content provider

0.03 2 0.06

6 Agreement with TM for high-speed

broadband access.

0.08 4 0.32

7 Collaboration with Limkokwing University

to improve tertiary mobile learning

0.02 2 0.04

8 Broaden 4G throughout Sabah and

Sarawak

0.03 3 0.09

9 Maxis entered into an agreement with

Tenaga Nasional Berhad to utilize the

latter’s structure which provides

0.03 3 0.09

10 Maxis Academy to improve productivity 0.05 4 0.20

THREATS

1 The release of the Digi iPhone 0.05 4 0.20

2 Rate adjustments for interconnection 0.03 2 0.06

3 Aggressive broadband offers by wireless

competing companies

0.08 4 0.32

4 Low dividend yield compared to Digi 0.04 2 0.08

5 Expanding 3G faces competitive pressures 0.03 2 0.06

6 No hidden fees with the competitor's

service.

0.06 3 0.18

7 Celcom has announced a 7-day free call

promotion for customers celebrating their

birthdays

0.05 2 0.10

8 Maxis ranks second to Celcom in terms of

wireless broadband market share

0.07 2 0.14

9 New WiMAX players have entered the

market

0.05 3 0.15