- Information

- AI Chat

Was this document helpful?

05-23-2022 CRC-ACE - AFAR - Week 01 Accounting for Partnership - Part 1 Operations

Course: BS accountancy

999+ Documents

Students shared 13151 documents in this course

University: University of Cebu

Was this document helpful?

ADVANCED FINANCIAL ACCOUNTING & REPORTING PROF. ROEL E. HERMOSILLA

WEEK 1 - ACCOUNTING FOR PARTNERSHIP

PARTNERSHIP OPERATIONS

Allocation of Partnership Income (Loss)

The partners should have a written agreement, called articles of co-partnership, specifying the

manner in which partnership income (loss) is to be distributed. Note that in the absence of a

predetermined agreement, the profit and loss (P&L) is divided according to original capital contributed

by partners.

A number of issues arise which complicate the allocation of partnership income (loss).

1. Partners may receive interest on their capital balances. If so, it must be determined what

constitute the capital balance (e.g., the year-end amount of some type of weighted-average).

2. Some of the partners may receive a salary.

3. Some of the partners may receive a bonus on distributable net income. If so, you need to

determine if the bonus should be computed before or after salary, interest and bonus allocations.

4. A formula needs to be determined for allocating the remaining income. The formula agreed upon

is usually termed the residual, remainder, or profit (loss) sharing ratio.

Finally, the partners should decide upon how income is to be allocated if net income is insufficient to

cover partner’s salaries, bonuses, and interest allocations. These allocations are usually made even if the

effect is to create a negative remainder. This is important to note that partners may choose to allocate

losses (or a negative remainder) in a different manner than income.

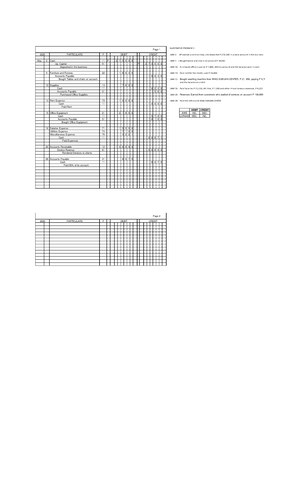

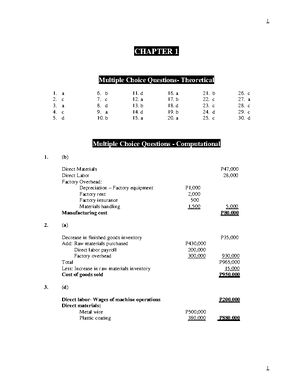

Example: Partnership P & L Distribution

A, capital P300,000; B, capital P100,000; and C, capital P50,000

Partners receive 5% interest on beginning capital balances

Partner B receives a P60,000 salary

Partner C receives a 10% bonus after interest and salaries

The P&L ratios are A – 50%; B – 30%; C – 20%

Assuming partnership net income of P182,500, the distribution schedule would be prepared:

A

B

C

Total

5% interest on beginning capital

P15,000

P 5,000

P 2,500

P 22,500

Salary to partner B

60,000

60,000

Bonus to partner C after interest &

salaries

10,000*

10,000

Remaining distribution 50:30:20:

45,000

27,000

18,000

90,000

Total share

P60,000

P92,000

P30,500

P182,500

*(P182,500 – P22,500 – P60,000) x .10 = P10,000

Note that if the interest, salary, and bonus allocation had exceeded net income, the excess would

have been deducted on the distribution schedule in the P&L ratio.

Note also, that if the bonus is based on net income after interest, salary and bonus then, bonus

would have been computed as follows: P182,500 – P22,500 – P60,000 divided by 110% x 10%.

Sometimes, problems in the CPA board exam will require the examinee to determine first the net

income before allocation is made. In this case, the method of determining net income must first be

determined in order to compute the distributed net income. If the problem is silent as to the method

used, then the generally accepted method must be the accrual basis of accounting net income.

T

Th

he

e

P

Pr

ro

of

fe

es

ss

si

io

on

na

al

l

C

CP

PA

A

R

Re

ev

vi

ie

ew

w

S

Sc

ch

ho

oo

ol

l

Davao

3/F GCAM Bldg. Monteverde St. Davao City

0917-1332365

Baguio

2nd Flr. #12 CURAMED Bldg. Marcos Highway, Baguio City

0906-0775156 / 09618683385

Main: 3F C. Villaroman Bldg. 873 P. Campa St. cor Espana, Sampaloc, Manila

(02) 8735 8901 / 0917-1332365

email add: crc_ace@yahoo.com/crcacemanila.onlineenrollment@gmail.com